How To Invest Like a Bank

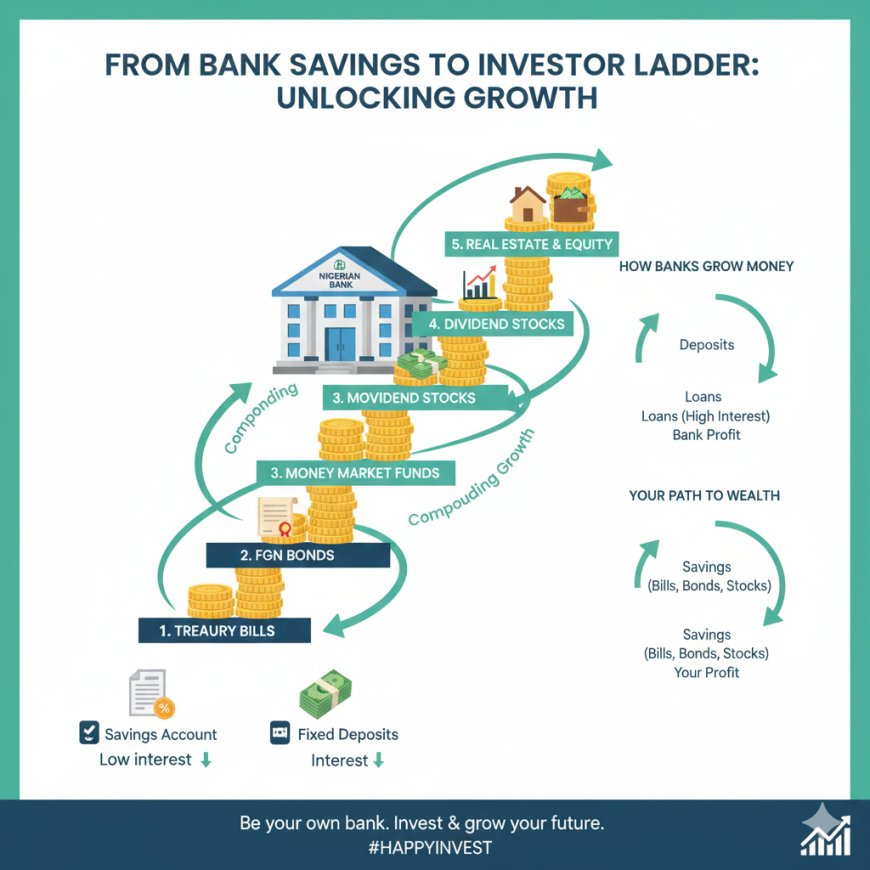

Banks are some of the most profitable businesses in Nigeria, not because of magic, but because they follow smart money principles. This article breaks down how Nigerian banks make money and shows students, salary earners, and young investors how to apply the same strategies using safe investments like Treasury Bills, Money Market Funds, bonds, and dividend stocks.

Bank Basics: How Banks Make Money

Introduction: Banks Are Not Magicians

Many people think banks make money by “magic.”

In reality, banks make money by doing very simple things repeatedly and at scale.

The good news?

👉 You can use the same ideas banks use to build wealth as an investor, even with small money.

Let’s break it down in simple terms.

1. What Is a Bank (In Simple Words)?

A bank is a business that:

-

Collects money from people (savings, deposits)

-

Lends that money out at a higher interest rate

-

Keeps the difference as profit

This difference is referred to as the interest spread.

📌 Example:

-

The bank collects money from you at 2–5%

-

Bank lends it out at 18–30%

-

The bank keeps the difference

2. How Nigerian Banks Make Their Money

A. Interest on Loans (Main Source)

Banks lend money to:

-

Individuals (personal loans)

-

Businesses

-

Government (T-bills, bonds)

📌 Example:

Zenith Bank gives a business loan at 25% interest.

How You Can Copy This

-

Invest in Treasury Bills

-

Invest in FG Bonds

-

Invest in Money Market Funds

You are lending money just like banks do — but with less risk.

B. Fees & Charges

Banks earn from:

-

SMS alerts

-

Transfer fees

-

Card maintenance fees

-

Account maintenance

📌 Small amounts × millions of users = big profit

How You Can Copy This

-

Invest in companies that earn recurring fees

-

Banks (Zenith, GTCO)

-

Telecoms (MTN)

-

Fintech-related stocks

-

You earn through dividends and price growth.

C. Investing Depositors’ Money

Banks don’t keep your money idle.

They invest in:

-

Treasury Bills

-

Government Bonds

-

Commercial Papers

📌 This is why banks still make money even during hard times.

How You Can Copy This

-

Put spare cash into Money Market Funds

-

Short-term Commercial Papers

-

Fixed income funds

You earn a daily or quarterly income just like banks.

D. Foreign Exchange (FX) & Treasury Activities

Banks make money by:

-

Buying and selling FX

-

Trading bonds and securities

How You Can Copy This

-

Invest in USD funds

-

Buy foreign stocks & ETFs

-

Hold part of your money in dollars

This helps protect you from the depreciation of the naira.

3. Why Banks Are Always Profitable

Banks follow strict rules:

-

They think long-term

-

They manage risk carefully

-

They earn small percentages consistently

-

They avoid emotional decisions

📌 Banks don’t chase “quick money.”

4. Investor vs Poor Mindset (Using Banks as an Example)

| Poor Thinking | Bank Thinking |

|---|---|

| Wants fast profit | Focuses on steady returns |

| Keeps money idle | Puts money to work |

| Spends first | Invests first |

| Chases hype | Follows systems |

To build wealth, think like a bank, not like a gambler.

6. Practical Ways to Invest Like a Bank (Nigeria)

Beginner Level

-

Money Market Fund

-

Treasury Bills

-

Dividend stocks (Zenith, GTCO)

Intermediate Level

-

FG Bonds

-

Commercial Papers

-

Balanced Mutual Funds

Advanced Level

-

USD investments

-

Dividend ETFs

-

Real estate income

6 Student & Salary Earner Example

Let’s say you earn ₦50,000 monthly:

-

₦10,000 → Money Market Fund

-

₦5,000 → Dividend stock

-

₦5,000 → Treasury Bills (when available)

Over time:

-

Your money earns interest

-

You receive dividends

-

Your capital grows

📌 That’s exactly how banks grow.

7. The Big Lesson

Banks don’t:

❌ Guess

❌ Rush

❌ Gamble

They:

✅ Lend safely

✅ Earn interest

✅ Collect fees

✅ Reinvest profits

If you copy these principles as an investor, wealth becomes predictable.

Final Thought

You don’t need to own a bank to invest like one.

Start small.

Be consistent.

Let time and compounding do the work.

The richest people don’t work harder, they make money work harder.