Common Saving Mistakes Nigerians Make (And How to Fix Them)

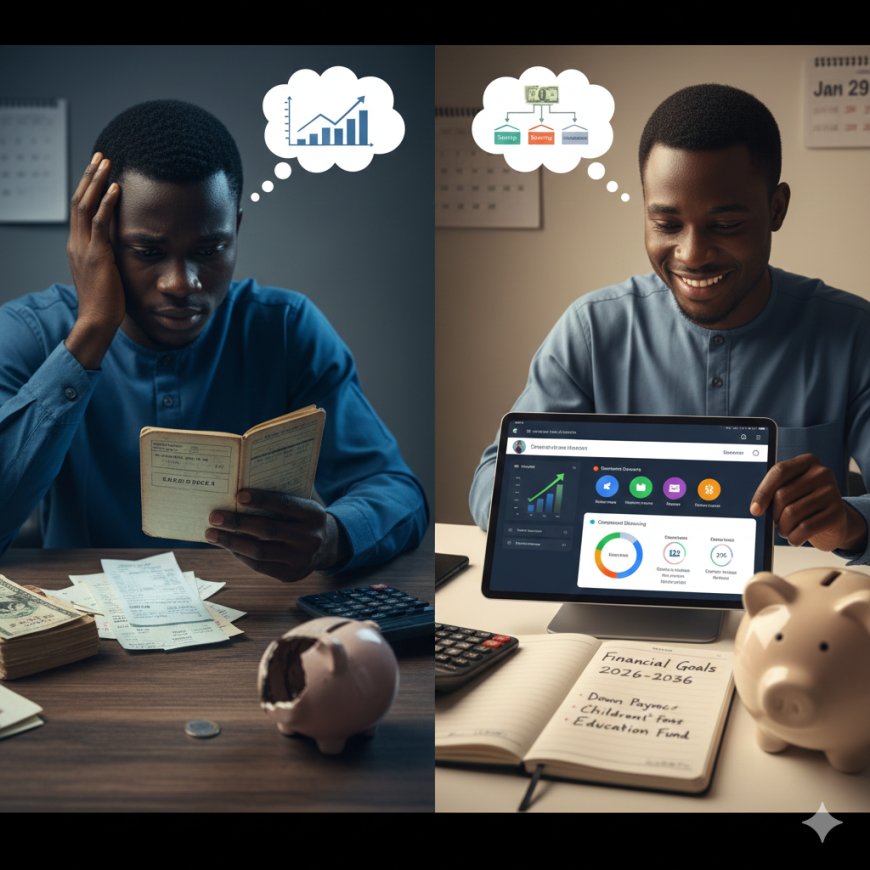

Are you saving money but not seeing progress? Learn the common saving mistakes Nigerians make and how to build smarter, more effective savings

Many Nigerians save money.

Yet many still feel financially stuck.

They save small amounts, stop midway, borrow back what they saved, or watch inflation silently reduce the value of their money.

The issue is not the act of saving

It’s how saving is done.

In this article, we’ll break down the most common saving mistakes Nigerians make, why they happen, and what to do differently to build real financial security.

1. Saving Without a Clear Purpose

One of the biggest mistakes is saving just to save.

People say:

“I’m saving small-small.”

But when you ask:

“What are you saving for?”

There’s no clear answer.

Without purpose:

-

Savings get spent easily

-

Motivation fades

-

Progress feels meaningless

==> Fix:

Every savings plan must have a job:

-

Emergency fund

-

School fees

-

Business capital

-

Investment transition

Purpose protects money.

2. Treating Savings as Optional

Many Nigerians save only when money is left.

Savings become:

-

Flexible

-

Negotiable

-

Easily sacrificed

This mindset ensures savings never grow.

==> Fix:

Pay yourself first.

Savings should be treated like a fixed bill, not a leftover.

3. Ignoring Inflation Risk

Saving in cash alone is dangerous in Nigeria.

Inflation silently reduces purchasing power every year.

What your money buys today

will buy less tomorrow.

Many savers don’t realize they are losing value while saving.

==> Fix:

-

Keep emergency funds liquid

-

Move long-term savings into investments

-

Learn basic investing early

Saving is protection, investing is growth.

4. Saving Without Emergency Coverage

Some people save for goals

but have no emergency fund.

So when life happens:

-

Savings are wiped out

-

Debt increases

-

Discouragement sets in

==> Fix:

Always build an emergency fund first (3–6 months of expenses).

5. Using Savings as Spending Money

Savings are often treated as:

-

Backup wallet

-

Emergency ATM

-

Convenience fund

This destroys consistency.

==> Fix:

Separate:

-

Spending account

-

Emergency savings

-

Goal savings

What is easy to access is easy to spend.

6. Depending on Informal Saving Systems Alone

Ajo, Esusu, and cooperative savings are popular and helpful.

But relying on them alone has risks:

-

No protection

-

No growth

-

Limited flexibility

==> Fix:

Use informal savings for discipline,

But combine them with formal savings and investments.

7. Saving Too Little for Too Long Without Review

Saving ₦5,000 monthly is good, but only if reviewed.

Many people:

-

Save the same amount for years

-

Ignore income changes

-

Fall behind inflation

==> Fix:

Review savings every 6–12 months and adjust upward when income grows.

8. Not Tracking Progress

People save blindly.

No tracking.

No milestones.

No celebration of wins.

Without feedback, consistency drops.

==> Fix:

Track savings monthly and set clear targets.

9. Mixing Savings With Debt

Saving while carrying high-interest debt is common.

This creates frustration:

-

Savings grow slowly

-

Debt grows faster

== > Fix:

Clear high-interest debt first while saving minimally for emergencies.

Saving money is good

Saving money correctly is better.

Most saving mistakes Nigerians make are not about discipline, but a lack of structure and education.

Once you:

-

Save with purpose

-

Protect against inflation

-

Separate accounts

-

Review regularly

Saving becomes empowering, not frustrating.

At Happyinvest.ng, our goal is simple:

Help Nigerians save smarter, not harder.