How to Make Money as an Investor in a Falling Inflation Rate

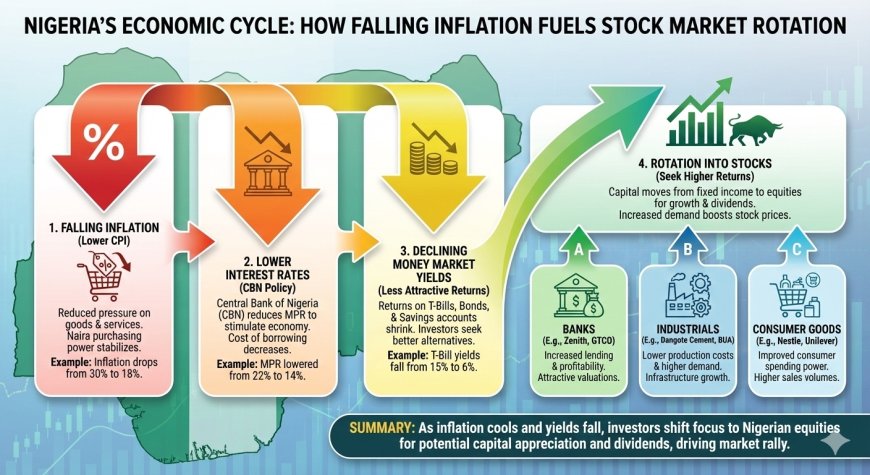

As inflation in Nigeria falls to multi-year lows, smart money begins rotating from fixed income into stocks. This guide explains how falling inflation affects interest rates, money market returns, and sector performance, and how investors can position early to benefit from the next NGX bull run.

A few years ago, inflation was the biggest enemy of Nigerian investors.

Prices were rising.

Interest rates were high.

Money market funds were paying crazy returns.

Stocks felt boring.

Bonds felt “safe but useless.”

But things are changing.

According to recent data, inflation has dropped to a 6-year low of about 14.45%.

And when inflation falls, money starts moving.

If you understand where money moves next, you can make money before everyone else catches on.

Let me explain this in simple terms.

The Simple Logic: High Inflation vs Low Inflation

When Inflation Is High (30%+)

-

Interest rates go up

-

Treasury Bills pay high returns

-

Money market funds look very attractive

-

Stocks feel risky

So investors hide in:

-

T-Bills

-

Bonds

-

Fixed income

Safe, boring, but predictable.

When Inflation Falls (like now – 14.45%)

Everything changes.

-

Interest rates start coming down

-

Treasury Bill yields drop

-

Money market returns fall

-

Stocks start to look attractive again

Why?

Because when rates fall:

👉 Dividends start looking “fat.”

👉 Borrowing becomes cheaper

👉 Company profits improve

This is where smart investors wake up.

The Rotation: The Signs Are Already There

When inflation falls, money doesn’t disappear.

It rotates.

From:

-

Money market funds

-

Fixed income

-

Treasury Bills

Into:

-

Dividend stocks

-

Growth stocks

-

Strong sectors

One key sign:

-

Money market yields are peaking

-

Bond yields are already dropping

This tells us something important:

Big money is quietly leaving safety and positioning for growth. big investors start moving large volumes early — before headlines start shouting “bull market.”

Who Wins When Inflation Falls?

Not every company wins.

But some sectors benefit more than others.

1. Banks

Examples:

-

GTCO

-

Zenith Bank

Why banks win:

-

Interest rates fall

-

Borrowing increases

-

Lending books grows

-

Profits improve

Banks usually perform very well at the early stage of a market recovery.

2. Industrial Companies

Examples:

-

Dangote Cement

-

WAPCO

Why they win:

-

Cost of production falls

-

Energy and borrowing costs reduce

-

Margins improve

Lower inflation = cheaper production.

3. Consumer Goods Companies

Examples:

-

Nigerian Breweries

-

Guinness

-

Presco

Why they win:

-

Food inflation eases

-

People have more disposable income

-

Spending increases

When essentials become cheaper, people start buying “extras” again.

What Smart Investors Are Doing Now

Here’s the key insight:

Fixed income is becoming less attractive.

Why?

Because:

-

Money market returns are falling

-

Bonds bought now may lock you into lower yields

So smart investors are:

-

Locking in dividend-paying stocks

-

Positioning early before the crowd

-

Preparing for a rotation into equities

This phase is quiet.

It doesn’t feel exciting yet.

But this is where money is made.

The Big Picture: The Great Rotation

We are entering what professionals call “The Great Rotation.”

That is when:

-

Money moves from fixed income

-

Into stocks and productive assets

By the time everyone is talking about a bull run:

-

Prices are already higher

-

The easy gains are gone

So, How Do You Make Money in Falling Inflation?

Here’s the simple strategy:

- Reduce over-exposure to money market funds

- Start positioning in:

-

Strong banks

-

Industrial stocks

-

Consumer goods stocks

3. Focus on dividend-paying companies

4. Think long-term, not quick flips.

You don’t need to rush.

You just need to position early.

Final Thought

Falling inflation is not bad news.

For informed investors, it is an opportunity disguised as calm.

The market doesn’t shout when it’s about to move.

It whispers.

And those who listen early…

are the ones who make the most money.

Keep learning.

Keep positioning.

The game is the game. 📈