How Banks Make Money From Your Deposits

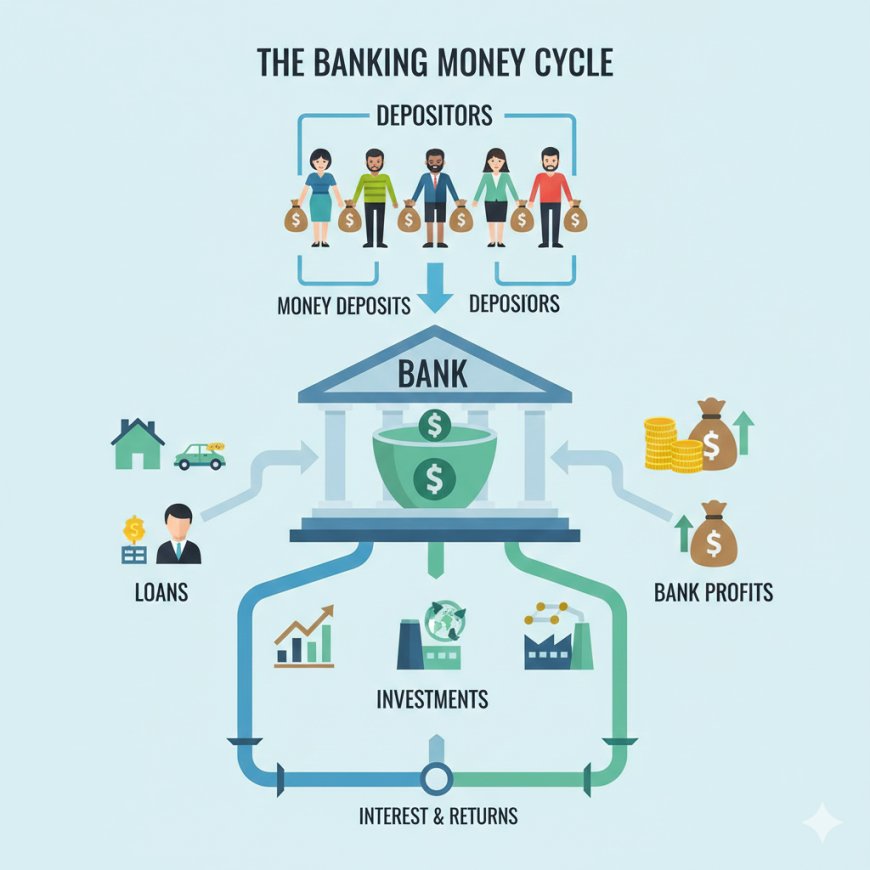

Ever wondered how banks make money from your deposits? This article explains the banking system, interest spreads, and how your money really works.

You deposit money in the bank.

You check your balance.

Everything looks calm.

But behind the scenes, your money is working hard, just not always for you.

Many people believe:

“My money is just sitting in the bank.”

That’s not true.

Banks don’t keep your money idle.

They use it to make more money.

In this article, we’ll explain how banks make money from your deposits, why this system exists, and what it means for you as a saver or investor.

What Happens When You Deposit Money?

When you deposit money:

-

The bank does not lock it in a vault

-

The bank records it as a liability (they owe you)

-

The bank is allowed to use most of it

This system is legal, regulated, and global.

It’s called fractional reserve banking.

1. Banks Lend Out Your Money

The primary way banks make money is through lending.

Your deposit becomes:

-

Personal loans

-

Business loans

-

Mortgages

-

Credit facilities

Example:

-

You deposit ₦1,000,000

-

The bank may keep a small percentage as a reserve

-

The rest is lent out at interest

The borrower pays interest.

The bank earns that interest.

2. Interest Rate Spread (The Bank’s Main Profit)

Banks pay you:

-

Very low interest on savings

They charge borrowers:

-

Much higher interest on loans

This difference is called the interest spread.

Example:

-

You earn 2% on savings

-

Borrowers pay 18%–30%

-

The spread = bank profit

Your money is the raw material.

3. Fees and Charges Multiply the Profit

Even without lending, banks earn through:

-

Account maintenance fees

-

Transfer charges

-

SMS alerts

-

Card fees

-

ATM fees

-

FX margins

These fees add up quietly.

Millions of customers × small fees = massive income.

4. Banks Invest Deposits

Banks also invest deposits in:

-

Government securities

-

Treasury bills

-

Bonds

-

Money market instruments

These investments are:

-

Low-risk

-

Predictable

-

Income-generating

Your deposit helps fund these investments.

5. Banks Create Money Through Credit

This surprises many people.

When banks lend, they don’t always move existing cash.

They create credit electronically.

This expands money in the system and increases:

-

Bank influence

-

Interest income

-

Economic activity

This is why banks are heavily regulated.

Is This System Bad or Dangerous?

No, when properly regulated.

The banking system:

-

Supports businesses

-

Funds economic growth

-

Provides liquidity

-

Enables payments and trade

The issue is not that banks use your money.

The issue is:

Most people don’t understand how it works or how to benefit too.

What This Means for You

If your money:

-

Sits in savings

-

Earns little interest

-

Loses value to inflation

Then:

-

The bank wins

-

You fall behind slowly

Banks understand money deeply.

You should, too.

How You Can Use This Knowledge Wisely

-

Keep only short-term money in savings

-

Use savings for emergencies, not wealth

-

Learn to invest excess funds

-

Understand interest, inflation, and returns

-

Stop assuming banks exist to grow your wealth

Banks are businesses, not financial planners.

A Simple Truth

Banks are excellent at:

-

Using money

-

Compounding returns

-

Managing risk

You can learn the same principles.

At Happyinvest.ng, we believe:

Understanding money systems is the first step to financial independence.

Banks make money from your deposits because:

-

They understand leverage

-

They understand interest

-

They understand systems

Once you understand these, too,

You stop being just a saver

and start becoming an investor.