How to Use P/E Ratio, Dividend Yield & Key Ratios to Buy Stocks on NGX (A Practical Guide)

Stop Guessing. Start Buying Stocks with Sense.

A Short Story Before We Begin

Tunde bought a stock because someone on WhatsApp said:

“This stock is cheap. Buy now!”

He didn’t ask:

-

Is it actually cheap?

-

Is the company making money?

-

Will it pay dividends?

Three months later, the stock dropped.

Tunde blamed the market.

But the truth is simple:

He bought without understanding the numbers.

This article will make sure you don’t repeat that mistake.

First: Why Stock Ratios Matter

Every stock has two seasons:

-

Cheap season

-

Expensive season

Stock ratios help you know:

✔ When a stock is cheap

✔ When it is overpriced

✔ When you’re buying value or hype

If you understand just five ratios, you’re already ahead of most investors on NGX.

1. Earnings Per Share (EPS) — The Foundation

EPS tells you how much profit belongs to ONE share.

How to Calculate EPS

EPS = Total Company Profit ÷ Total Number of Shares

Example

-

Profit = ₦10,000,000

-

Shares = 1,000,000

EPS = ₦10

📌 This ₦10 is what all other ratios depend on.

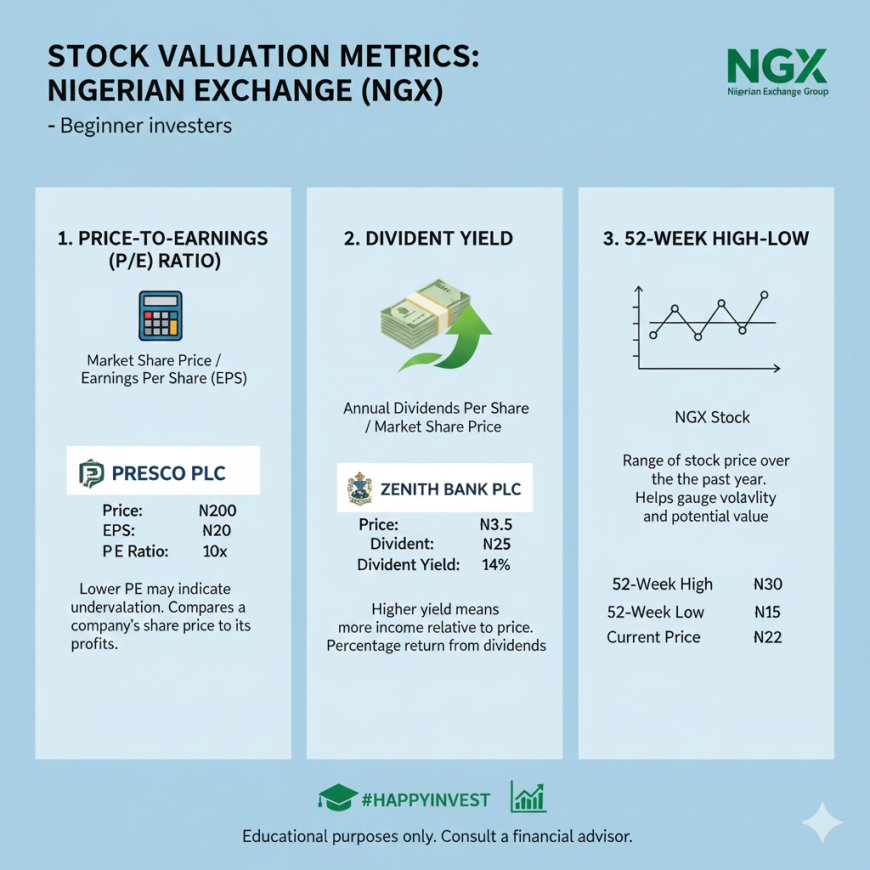

2. P/E Ratio: Am I Overpaying for This Stock?

P/E answers one simple question:

How much am I paying for ₦1 of company profit?

How to Calculate P/E

P/E Ratio = Share Price ÷ EPS

Example

-

Share price = ₦100

-

EPS = ₦10

P/E = 100 ÷ 10 = 10

How to Interpret It

-

P/E below 10 → cheap / undervalued

-

P/E 10–15 → fair

-

P/E above 25 → expensive or hyped

📌 Paying too much for earnings is like buying pure water for ₦400 — unnecessary pain.

3. Dividend Yield: How Much Cash Will This Stock Pay Me?

Dividend yield shows how much cash you earn yearly for holding the stock.

How to Calculate Dividend Yield

Dividend Yield (%) = (Dividend per Share ÷ Share Price) × 100

Example

-

Share price = ₦100

-

Dividend = ₦10

Dividend Yield = (10 ÷ 100) × 100 = 10%

📌 In Nigeria, dividend-paying stocks are very important for steady income.

Rule of Thumb

-

Above 5% → attractive

-

3–5% → okay

-

Below 2% → avoid if price is already high

4. Price-to-Book Ratio (P/B): Is This Stock Selling Below Its Real Value?

P/B compares the stock price to the company’s actual worth.

How to Calculate Book Value

Book Value = Total Assets − Total Liabilities

Book Value per Share = Book Value ÷ Total Shares

How to Calculate P/B

P/B = Share Price ÷ Book Value per Share

📌 P/B below 1 often means undervalued (very useful for banks).

5. Return on Equity (ROE): How Smart Is Management?

ROE shows how well the company uses investors’ money.

How to Calculate ROE

ROE (%) = (Net Profit ÷ Shareholders’ Equity) × 100

Rule

-

ROE above 15% → good

-

Above 20% → excellent

📌 High ROE = strong management.

6. Debt-to-Equity Ratio: Is This Company Owing Too Much?

This tells you how risky the company is.

How to Calculate

Debt-to-Equity = Total Debt ÷ Shareholders’ Equity

Rule

-

Below 1 → safe

-

Above 2 → risky

📌 Too much debt can destroy profits during hard times.

7. 52-Week High & Low — Are You Buying Early or Late?

This shows the:

-

Highest price in 1 year

-

Lowest price in 1 year

How to Use It

-

Price near 52-week low → better buying zone

-

Price near 52-week high → buy small or wait

📌 This prevents buying at the top.

The Smart Investor’s 5-Question Checklist

Before buying any NGX stock, ask:

1️⃣ Is EPS growing?

2️⃣ Is P/E fair?

3️⃣ Is the dividend attractive?

4️⃣ Is debt low?

5️⃣ Is the price near the yearly low?

If most answers are YES, you’re investing — not gambling.

The Golden Strategy: Buy Small-Small (Dollar-Cost Averaging)

Never put all your money at once.

Buy gradually:

-

₦5,000

-

₦10,000

-

₦20,000 every month

If price drops — no tears.

If price rises — smiles.

Mama Ngozi calls it:

“Buy am small-small make e no pain you.”

Final Lesson (Very Important)

Most people don’t lose money because the market is bad.

They lose money because:

❌ They follow hype

❌ They ignore numbers

❌ They buy emotions

But once you understand these ratios:

-

Investing stops feeling like betting

-

Confidence replaces fear

-

Money starts working for you

As Mama Ngozi says:

“If my money no dey sleep again, e must dey work.”

Final Advice

Don’t fear the market.

Fear ignorance.

Start small.

Learn as you go.

Let time and compounding fight for you.