Why Volume Matters More Than Price

Learn why volume matters more than price in stocks and investing. Discover how volume confirms trends and protects you from false market signals.

Most people look at only one thing in the market:

“Is the price going up or down?”

But experienced traders and long-term investors know a deeper truth:

Price tells you what happened.

Volume tells you why it happened and whether it will last.

Price can lie.

Volume rarely does.

In this article, you’ll learn what volume is, why it matters more than price alone, and how understanding volume can protect you from false signals and costly mistakes.

What Is Volume in the Market?

Volume refers to:

-

The number of shares, units, or contracts traded

-

Within a specific period (day, hour, week)

Simply put:

-

Price = movement

-

Volume = participation

Price shows direction.

Volume shows conviction.

Why Price Alone Can Be Misleading

Price can move:

-

On rumors

-

On low participation

-

On manipulation

-

On short-term hype

A price increase without strong volume often means:

-

Weak interest

-

Temporary move

-

High risk of reversal

This is why many “hot stocks” rise quickly, then crash.

Volume Reveals Real Market Interest

High volume means:

-

Many buyers and sellers agree

-

Institutions may be involved

-

The move is more credible

Low volume means:

-

Few participants

-

Weak demand or supply

-

Easy price manipulation

Markets move sustainably only when volume supports price.

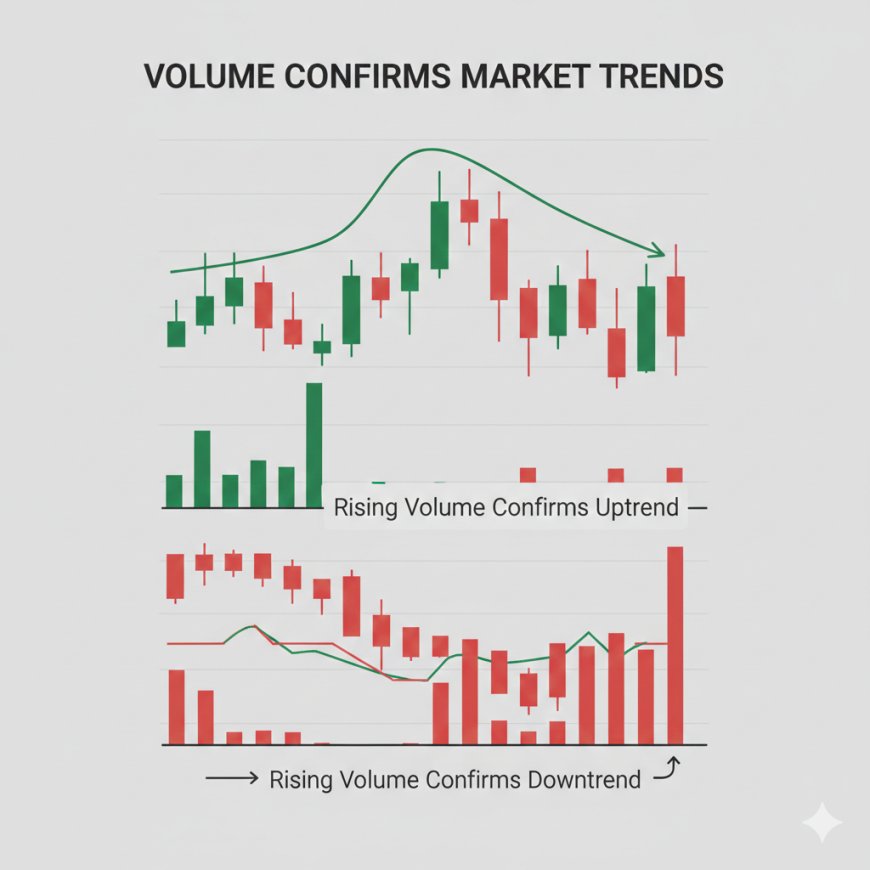

Volume Confirms Trends

Price Up + Volume Up

✔ Strong bullish signal

✔ Trend likely sustainable

Price Up + Volume Down

⚠ Weak rally

⚠ Possible fake breakout

Price Down + Volume Up

✔ Strong selling pressure

✔ Trend likely to continue

Price Down + Volume Down

⚠ Weak decline

⚠ Selling pressure may be fading

Volume acts as the truth filter.

Why Big Players Watch Volume First

Large investors and institutions:

-

Cannot hide their trades easily

-

Leave footprints through volume

-

Accumulate positions quietly

Price moves after volume builds.

Smart money watches participation before direction.

Volume Helps You Avoid Traps

Many beginners buy because:

-

“The price is moving fast.”

-

“Everyone is talking about it.”

But without volume:

-

Moves can reverse instantly

-

Liquidity may disappear

-

Losses become hard to exit

Volume protects you from chasing noise.

Volume Works in All Markets

Volume matters in:

-

Stocks

-

Crypto

-

Forex

-

Commodities

-

ETFs

No matter the market:

Participation drives sustainability.

Price Is the Result.Volume Is the Cause

Think of it like this:

-

Price is the symptom

-

Volume is the diagnosis

Ignoring volume is like:

-

Treating fever without finding the infection

Markets reward understanding, not speed.

How Beginners Should Use Volume

You don’t need complex indicators.

Start with this:

-

Don’t trust price breakouts without volume

-

Avoid low-volume assets

-

Look for rising volume in strong trends

-

Use volume to confirm, not predict

Simple awareness already puts you ahead of most people.

Long-Term Investors Benefit Too

Even long-term investors should:

-

Watch volume during accumulation

-

Avoid thinly traded assets

-

Confirm institutional interest

Volume shows where confidence is building.

Price is loud.

Volume is honest.

If you only watch the price:

-

You react late

-

You chase moves

-

You absorb risk blindly

If you understand volume:

-

You see strength early

-

You avoid traps

-

You invest with clarity

At Happyinvest.ng, we believe:

Understanding how markets move is more important than predicting where they’ll go.

Volume is one of the clearest signals the market gives, if you learn to listen.