Budgeting Isn’t the Problem . Your Lifestyle Is

Budgeting isn’t failing you; your lifestyle is. Learn how lifestyle creep destroys finances, why budgeting alone doesn’t work, and practical steps Nigerians can take to realign spending, save more, and build wealth.

Budgeting Isn’t the Problem. Your Lifestyle Is

Let’s be honest for a moment.

Most people don’t have a budgeting problem.

They have a lifestyle problem.

You can download all the budgeting apps, attend finance seminars, and write expenses in a notebook every night, but if your lifestyle is bigger than your income, no budget will save you.

This is the truth many people don’t want to hear.

The Real Problem: Living Beyond Your Income

If you earn ₦150,000 a month but live like someone earning ₦400,000, budgeting becomes a joke.

Let’s break it down:

-

Expensive rent “because people will talk.”

-

New phone every year

-

Eating out almost daily

-

Weekend hangouts that swallow half your salary

-

Subscriptions you barely use

-

Data, rides, impulse shopping

Then at the end of the month, you say:

“Nigeria is hard.”

Nigeria is hard, but some lifestyles are harder than necessary.

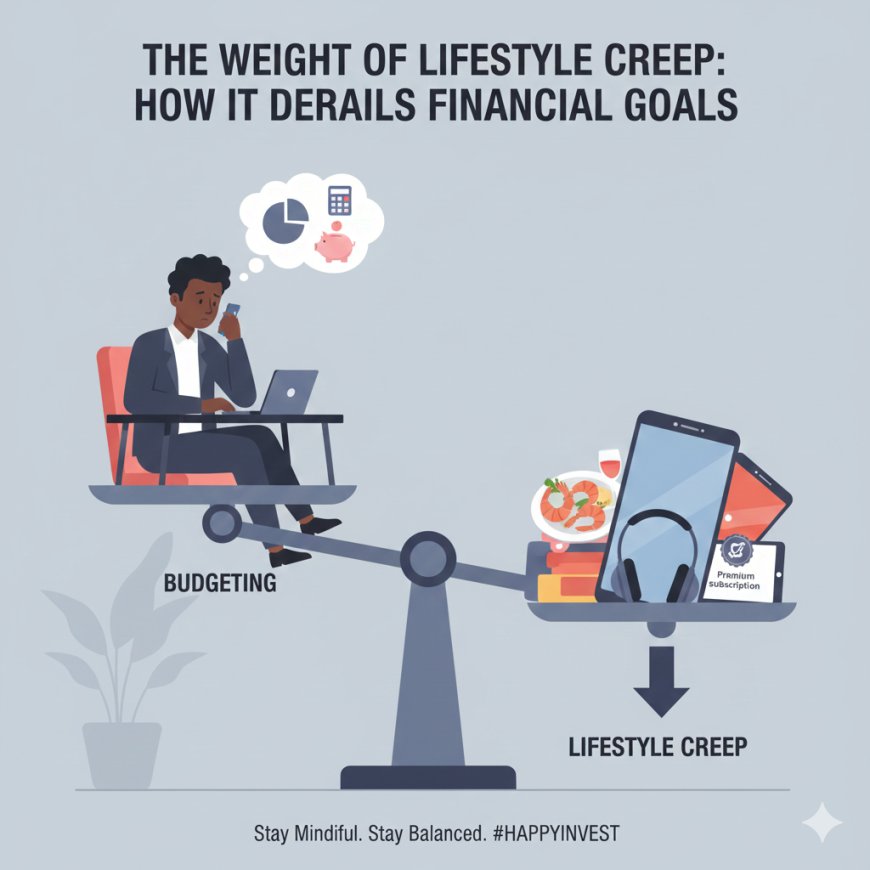

What Is Lifestyle Creep?

Lifestyle creep happens when:

-

Your income increases,

-

But your expenses increase faster.

Example:

You used to earn ₦80k and survive.

Now you earn ₦200k — yet you’re still broke.

Why?

Because:

-

You upgraded everything at once

-

You increased comfort, not wealth

-

You rewarded yourself before building security

Lifestyle creep is silent.

It doesn’t shout.

It just slowly eats your future.

Why Budgeting Alone Doesn’t Work

Budgeting only works when your lifestyle is realistic.

If your fixed expenses already take 90% of your income, budgeting becomes stress management, not wealth creation.

Budgeting is a tool.

Lifestyle is the engine.

A bad engine will destroy any good tool.

How to Realign Your Lifestyle (Practical Steps)

This is where real change happens.

1. Face Your Numbers Without Lying

List:

-

Your income

-

Your fixed expenses

-

Your lifestyle spending

No excuses.

No “rounding up.”

No hiding.

Reality is painful, but it’s powerful.

2. Separate Needs From Wants

Needs:

-

Food

-

Shelter

-

Transport

-

Basic data

Wants:

-

Frequent eating out

-

Latest gadgets

-

Lifestyle validation

-

Impressing people who won’t help you later

If your wants are higher than your needs, that’s the issue.

3. Downgrade to Upgrade

This is hard, but necessary.

-

Smaller apartment

-

Less frequent outings

-

Cheaper transport options

-

Fewer impulse buys

You’re not poor.

You’re strategic.

Temporary sacrifice creates permanent freedom.

4. Pay Yourself First

Before spending on life:

-

Save

-

Invest

-

Build emergency funds

Even ₦5k, ₦10k, ₦20k consistently matters.

Your future self needs priority, too.

5. Stop Competing With People Online

Instagram is not real life.

Twitter lifestyle is not reality.

WhatsApp status is not financial proof.

Many people you’re trying to match are:

-

In debt

-

Borrowing

-

One emergency away from collapse

Don’t copy results you don’t understand.

A Hard Truth Most People Ignore

You don’t need more money first.

You need better decisions first.

Money only amplifies who you already are.

If you mismanage ₦100k,

You’ll mismanage ₦500k.

The Wealth Mindset Shift

Poor mindset says:

“I deserve enjoyment now.”

Wealth mindset says:

“I deserve freedom later.”

One leads to stress.

The other leads to options.

Final Thought

Budgeting isn’t failing you.

Your lifestyle is asking your income to do what it simply can’t.

Fix the lifestyle.

Then the budget will work.

CTA:

Truth or lie?

Be honest with yourself.