Portfolio Mistakes Beginners Make

Discover the most common portfolio mistakes beginners make and learn how to avoid them to build a stronger, more balanced investment portfolio.

Many people start investing with excitement and high hopes — only to feel disappointed, confused, or discouraged months later.

The problem is rarely investing itself.

The real issue is portfolio mistakes that beginners don’t even realize they’re making.

A portfolio is not just a collection of stocks or assets. It’s a system. When that system is weak, even good investments can fail.

Let’s break down the most common portfolio mistakes beginners make — and how to avoid them.

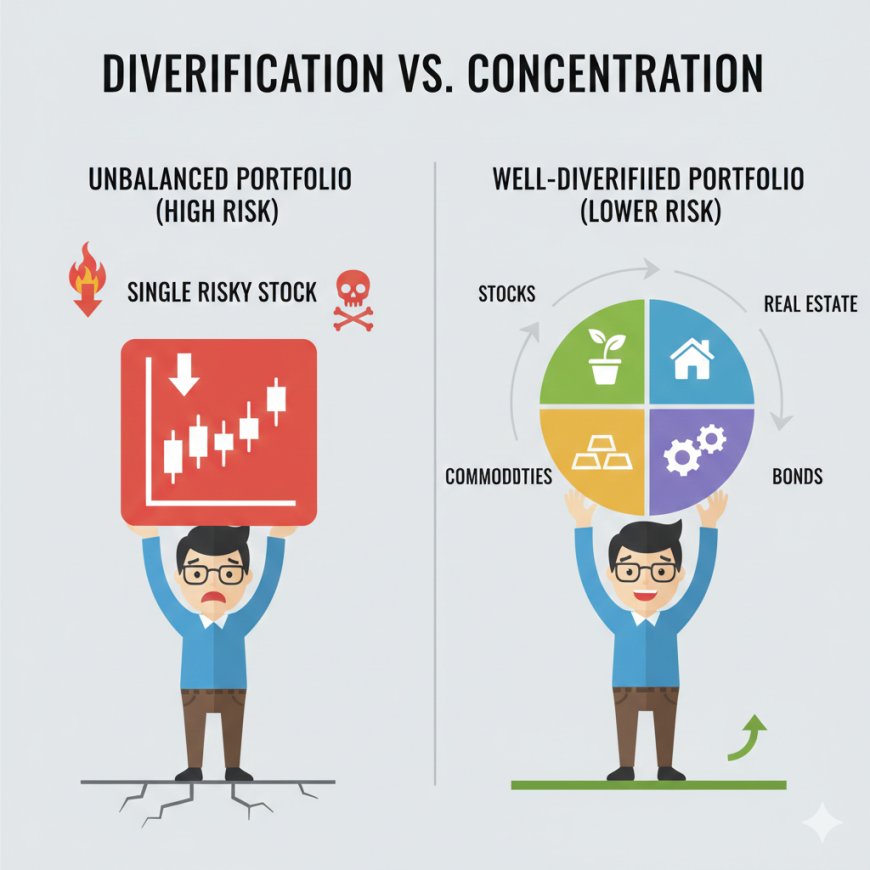

1. Putting All Their Money in One Asset

This is the most dangerous mistake.

Many beginners:

-

Buy only one stock

-

Invest everything in crypto

-

Depend on a single business or asset

If that one asset fails, the entire portfolio collapses.

This is why diversification exists.

Don’t try to be “sure.” Try to be safe.

2. Confusing Popularity With Safety

Beginners often think:

-

“Everyone is talking about it, so it must be good”

-

“It’s trending, so it can’t fail”

Popularity does not equal stability.

Highly talked-about assets:

-

Can be overvalued

-

Can crash quickly

-

Often attract late investors

A strong portfolio focuses on value and balance, not noise.

3. Overtrading and Constant Buying & Selling

Many beginners check their portfolio daily and react emotionally:

-

Selling too early out of fear

-

Buying too late out of excitement

-

Paying unnecessary transaction fees

Overtrading:

-

Increases costs

-

Reduces long-term returns

-

Creates stress and confusion

Good portfolios grow with time and patience, not constant action.

4. Ignoring Asset Allocation

Some beginners hold:

-

Too much high-risk assets

-

Too little stable investments

-

No clear balance at all

Asset allocation answers a simple question:

How much risk can I really handle?

A healthy portfolio usually includes:

-

Growth assets

-

Stable assets

-

Cash or near-cash assets

Ignoring allocation turns investing into gambling.

5. Chasing Fast Returns Instead of Sustainable Growth

Beginners often want:

-

“Quick doubling”

-

“Next big opportunity”

-

“Fast money”

This mindset leads to:

-

Poor decision-making

-

Exposure to scams

-

Emotional investing

Real wealth is built through consistent, repeatable growth, not lucky wins.

6. Not Reviewing Their Portfolio at All

Some beginners:

-

Invest once

-

Forget completely

-

Never rebalance or review

Markets change.

Personal income changes.

Goals change.

A portfolio needs periodic check-ups, not daily panic.

7. Investing Without Clear Financial Goals

Many people invest without knowing:

-

Why they’re investing

-

When they’ll need the money

-

What success looks like

Without goals:

-

Risk becomes unclear

-

Decisions become random

-

The results feel disappointing

Your portfolio should reflect:

-

Your timeline

-

Your income

-

Your future plans

Nigerian Reality Check

In Nigeria, beginners often face:

-

Inflation pressure

-

Currency devaluation

-

Limited financial education

This makes portfolio mistakes even more costly.

Smart Nigerian investors focus on:

-

Diversification across asset classes

-

Long-term thinking

-

Capital preservation first, growth second

A beginner portfolio doesn’t need to be perfect.

It just needs to be:

-

Diversified

-

Purpose-driven

-

Patient

-

Well-managed

Avoiding common mistakes is often more powerful than finding “hot” investments.