Betting or Buying a Stock in Nigeria: Which One Really Builds Wealth?

Many Nigerians bet every week hoping to get rich quickly, while others quietly build wealth by buying stocks. This article compares betting and investing in Nigerian stocks, explains the risks, mindset differences, and shows why ownership beats luck in the long run

Every weekend in Nigeria, the same thing happens.

Someone opens a betting app.

Another person checks the odds.

₦2,000 goes in.

Hope goes up.

Heart beats fast.

By Monday morning, most people are back to zero.

But somewhere else, quietly, another Nigerian buys shares.

No noise.

No odds.

No “sure banker.”

Just patience.

Let’s talk about the real difference.

The Emotional Trap of Betting

Betting feels good.

Why?

Because it gives instant hope.

You stake ₦2,000 and imagine turning it into ₦50,000 overnight.

Your brain loves that feeling.

But here’s the painful truth:

=> Betting is designed so that the house always wins.

You may win today.

You may even win big once.

But if you keep betting long enough, you will lose more than you gain.

That’s not opinion.

That’s math.

What Happens When You Buy a Stock?

Buying a stock is less exciting than betting.

No flashing odds.

No countdown.

No instant adrenaline.

But here’s what happens instead:

You own a real business.

If you buy GTCO:

-

You own part of a bank.

-

That bank makes money.

-

That money can be shared with you as dividends.

If you buy Dangote Cement:

-

You own part of a company that builds Nigeria.

-

As the country grows, the business grows.

That’s not luck.

That’s ownership.

Betting vs Buying a Stock (Simple Comparison)

| Betting | Buying a Stock |

|---|---|

| Based on chance | Based on business |

| Short-term thrill | Long-term growth |

| High emotional stress | Calm & steady |

| House always wins | The investor can win |

| Money disappears | Money can grow |

One is entertainment.

The other is investment.

“But I’ve Won Before” – The Honest Truth

Yes, some people win at betting.

Just like some people win lotteries.

But ask yourself:

-

Can you build a future on luck?

-

Can you plan your life around odds?

Most betting winners give the money back… slowly.

Most investors who stay patient grow wealth quietly.

Can Small Money Buy Stocks in Nigeria?

Yes.

You don’t need millions.

With ₦5,000–₦10,000 you can:

-

Buy stocks

-

Buy ETFs

-

Start learning the market

Unlike betting, your money doesn’t disappear after one game.

Why Stocks Feel Hard (But Aren’t)

Betting apps are simple.

Stocks feel complex.

But that’s because:

-

Betting apps want your money fast.

-

Investing rewards patience.

Once you learn:

-

How the stock market works

-

How to buy shares

-

How dividends work

You realize it’s not hard.

It’s just different.

The Biggest Difference Nobody Tells You

Betting asks:

“What will happen today?”

Investing asks:

“What will grow over time?”

That single question changes everything.

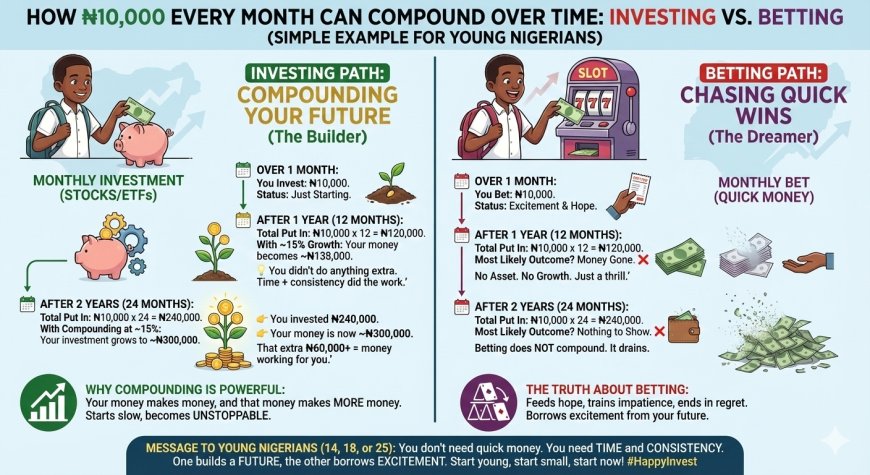

A Message to Young Nigerians

If you are 14, 18, or 25:

You don’t need quick money.

You need compound growth.

₦10,000 invested every month in stocks can change your life.

₦10,000 bet every weekend will not.

Final Thought

Betting takes money from the impatient and gives it to the patient (the house).

Investing takes money from the impatient and gives it to the patient (the investor).

The choice is yours.

Entertainment…

or ownership?

Start buying assets.

Your future will thank you.