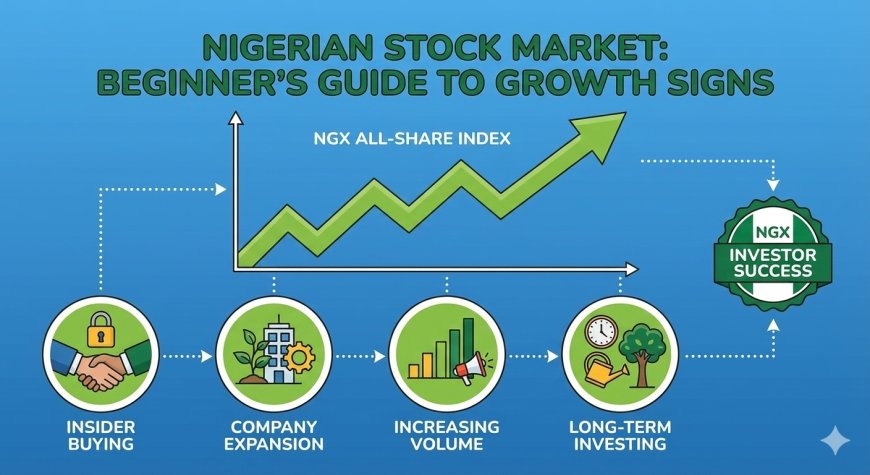

How to Know When a Stock Is About to Rise on the Nigerian Exchange (NGX)

Knowing when a stock is about to rise on the Nigerian Exchange requires more than guessing. This beginner-friendly guide explains key signals such as insider buying by CEOs and directors, improving company financials, rising trading volume, dividend strength, and business expansion—helping investors spot opportunities before prices move.

The Silent Clues Smart Investors Watch Before Prices Move

A Short Story You’ll Relate To

Aisha saw a stock trading at ₦12.

No noise.

No hype.

No WhatsApp “signals”.

But something strange was happening quietly.

The company’s CEO had just bought millions of shares.

Two board directors followed.

Then the share price moved from ₦12 to ₦18.

A few months later ₦25.

Most people only noticed after the rise.

Smart investors noticed before.

Let’s break it down.

1. Insider Buying: The Loudest Quiet Signal

If you remember only one thing, remember this:

When directors and CEOs buy their own company’s shares with their money, pay attention.

This is called insider buying.

Why Insider Buying Matters

-

Directors know the business better than anyone

-

They know upcoming results, contracts, or expansion

-

They won’t buy if trouble is ahead

📌 When insiders buy:

✔ It shows confidence

✔ It signals future growth

✔ It often happens before price rises

🚨 One insider is good.

🚨 Multiple insiders buying together is very strong.

2. Improving Financial Results (Before the Market Notices)

Before a stock rises, the numbers usually improve quietly.

Look for:

-

Revenue increasing

-

Profit turning positive

-

Losses reducing

-

Better cash flow

📌 Prices follow earnings, not vibes.

A company that was struggling but starts improving often attracts smart money first.

3. Unusual Trading Volume

Price movement alone is not enough.

Watch volume.

If:

-

Volume suddenly increases

-

But the price hasn’t moved much yet

That’s accumulation.

It means:

Big investors are buying quietly without pushing price too fast.

This usually comes before a breakout.

4. Consistent Dividend Payments

Dividend-paying companies attract serious investors.

If a company:

-

Pays dividends consistently

-

Increases dividend amount

-

Maintains payout even in tough times

It shows:

✔ Strong cash flow

✔ Good management

✔ Long-term stability

Dividend stocks often rise slowly but steadily.

5. Expansion News & Business Growth

Stocks move because businesses grow.

Watch for:

-

New factories

-

Expansion into new markets

-

New products

-

Strategic partnerships

-

Government contracts

📌 Growth news = future earnings = rising stock price.

6. Industry Tailwinds

Sometimes, it’s not the company — it’s the industry.

If:

-

Banks benefit from higher interest rates

-

Cement companies benefit from infrastructure spending

-

Telecoms benefit from data growth

Stocks in those sectors often rise together.

📌 Follow the money flow.

7. Institutional Investors Entering

When:

-

Pension funds

-

Asset managers

-

Mutual funds

Start buying a stock; it creates demand.

These investors:

✔ Buy in large amounts

✔ Hold long-term

✔ Push prices upward over time

Their buying doesn’t scream — it builds.

8. Technical Breakouts (But Only After Fundamentals)

Charts don’t predict the future alone — they confirm it.

Watch for:

-

Break above the resistance

-

Higher highs & higher lows

-

Long consolidation followed by a breakout

📌 Fundamentals start the move.

📌 Technicals confirm it.

Common Mistakes Beginners Make

❌ Buying after WhatsApp hype

❌ Chasing price after it has risen

❌ Ignoring company fundamentals

❌ Falling in love with cheap stocks

Cheap does not mean valuable.

Beginner Checklist: Signs a Stock Is About to Rise

✔ Insider buying

✔ Improving earnings

✔ Rising volume

✔ Strong dividends

✔ Sector growth

✔ Institutional interest

✔ Technical breakout

You don’t need all three — 3–4 together is powerful.

Final Thought

Stocks don’t rise randomly.

They rise because:

-

Insiders believe

-

Earnings improve

-

Big money enters

-

Businesses grow

By the time social media screams,

The opportunity is already gone.

Learn to watch quietly

That’s how real money is made on NGX.