How to Use P/E Ratio and Dividend Yield When Buying Stocks on NGX (Practical Guide)

Many Nigerian investors lose money by buying stocks based on hype. This practical guide explains how to use P/E ratio, dividend yield, and 52-week high/low to identify fairly priced NGX stocks and invest smarter, even with small amounts

Stop Guessing and Start Investing with Sense

Every stock goes through seasons:

Sometimes it’s cheap

Sometimes it’s expensive

If you learn how to read P/E Ratio and Dividend Yield, you’ll spot the cheap buys before most people and stop losing money.

Let’s break it down in a way anyone can understand.

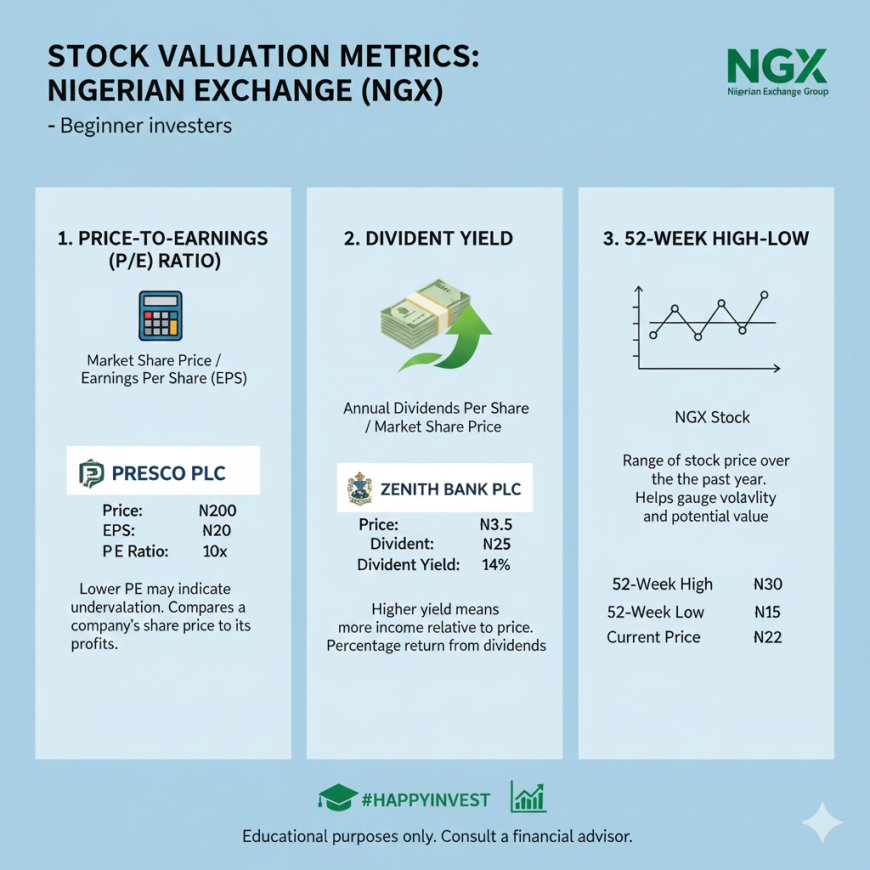

1. P/E Ratio: Are You Paying Too Much?

P/E Ratio simply answers this:

How much am I paying compared to what the company is earning?

📌 When the price is high compared to earnings → overhyped

📌 When the price is moderate compared to earnings → reasonable

Practical Example (Current Price)

Take Presco Plc — trading around ₦1,450 per share on NGX right now. (NGN Market)

If Presco earns, say, ₦150 per share yearly, its P/E would be around 10. That’s fair. If the P/E were 40, you’d be paying way too much for each naira the company makes.

Rule of Thumb:

-

P/E < 10 → undervalued

-

P/E 10–15 → fair

-

P/E > 25 → expensive (unless the company’s earnings are growing fast)

👉 Short: The

P/E ratio helps you decide if a stock is cheap, fair, or expensive before you buy.

2. Dividend Yield — How Much Cash Does the Company Pay You?

Dividend yield shows:

How much money the company pays you yearly for holding the stock.

How It Works (Example)

If Presco pays ₦50 per share annually, and the current price is ₦1,450, that is about 3.4% dividend yield.

Meaning:

-

For every ₦100 you invest, you get ₦3.40 back each year

-

That’s cash in your pocket for holding shares

Compare Another Stock

Zenith Bank is trading around ₦63 per share.

Zenith is known for consistent dividends and strong earnings. If Zenith pays, for example, ₦5 per share annually, its dividend yield is around 8% — which is great for income investors.

Rule of Thumb:

-

Dividend > 5% → attractive

-

Dividend 3–5% → moderate

-

Dividend < 2% → don’t buy if price is already high

👉 Short: Dividend yield tells you how much “thank you money” the company sends you for holding shares.

3. 52-Week High & Low: Are You Buying Little or Too Late?

Knowing the 52-week high and low is like checking the temperature.

-

If Presco’s 52-week low is ₦475 and its high is ₦1,550 → its current price ₦1,450, is near the top.

-

If Zenith’s 52-week low is ₦43 and high is ₦78.50, and the current price is ₦63, it’s somewhere in the middle.

How to Use This Info

✔ If price is near the low → better buying zone

✔ If price is near the high → buy small or wait for a dip

📌 This helps you avoid buying after the big rise — which is a common beginner mistake.

How to Use All Three Together (Simple Checklist)

Before you buy any NGX stock, ask:

-

Is the P/E ratio fair?

(Are you paying too much for earnings?) -

Is the dividend yield attractive?

(Will this stock pay you decent cash?) -

Is the price closer to its 52-week low than its high?

(Are you buying at a reasonable level?)

If YES to most → consider buying

If NO to most → rethink or buy smaller

Smart Buying Strategy: Naira-Cost Averaging (NCA)

Smart investors don’t put all their money in at once.

They buy “small-small” every month:

-

₦5,000

-

₦10,000

-

₦20,000

If the price dips tomorrow, they don’t cry.

If the price rises, they smile.

This strategy is called Naira-Cost Averaging: a method that reduces risk and builds wealth slowly.

Mama Ngozi explains it best:

“Buy am small-small make e no pain you.”

Why Many People Lose Money

Not because the market is bad.

But because they:

❌ Buy based on hype

❌ Ignore P/E ratios

❌ Forget dividend yield

❌ Buy at top prices

Investing becomes a gamble when logic is missing.

Final Words

If you can answer these three questions before buying:

-

Is the P/E fair?

-

Is the dividend good?

-

Is the price near low or high?

…you’ll already beat 99% of people in the market.

Investment is not for “big men in agbada”.

If you can spend ₦10k on shawarma, data, or outings…

You can invest the same ₦10k into stocks that pay you back for life.

Even Mama Ngozi now owns shares — she doesn’t speak finance grammar, but she knows:

“If my money no dey sleep again, e must be working.”

Don’t fear the market, fear ignorance.

Start small, learn as you go, and let time and compounding work for you.