Before Buying ETFs in the Nigerian Stock Market: What Every Investor Must Know

Thinking of buying ETFs in Nigeria? Learn how ETFs work on the Nigerian Exchange, their risks, advantages, best options on NGX, and how to invest safely before putting your money in

Imagine this.

Chinedu just saved his first ₦20,000.

He wants to invest, but one question keeps disturbing him:

“What if I buy the wrong stock and lose everything?”

That fear is exactly why many Nigerians are now asking about ETFs.

Before you buy any ETF in the Nigerian stock market, sit with me for a few minutes. Let me explain it like a story, not like a textbook.

1. What Are ETFs and How Do They Work?

What is an ETF?

ETF means Exchange Traded Fund.

Think of an ETF like a basket of investments.

Instead of buying one stock, you buy many stocks (or assets) at once, all packed inside one product.

📌 Example:

Buying GTCO shares is like betting on one student in a class.

Buying an ETF is like betting on the whole class.

ETF vs Buying Individual Stocks

| Buying One Stock | Buying an ETF |

|---|---|

| High risk if the company fails | Risk is spread |

| Needs deep research | Easier for beginners |

| Can be very volatile | More stable |

Can You Lose Money with an ETF?

Yes, you can lose money.

But here’s the difference:

-

If one company performs badly → ETF may still survive

-

If the whole market crashes → ETFs can drop too

So ETFs are safer than buying one stock, but not risk-free.

Advantages of ETFs

✅ Diversification (many assets at once)

✅ Beginner-friendly

✅ Lower risk than single stocks

✅ You can buy and sell like normal shares

✅ Some pay dividends

Disadvantages of ETFs

❌ Returns may be slower

❌ Market downturn affects them

❌ Some ETFs have low trading volume in Nigeria

2. Which ETFs Are Worth Investing In on NGX?

Now let’s talk about the real question people ask online:

“Which ETF is the best in Nigeria right now?”

There is no single “best” ETF for everyone.

The best ETF depends on:

-

Your goal

-

Your risk tolerance

-

Whether you want growth, dividends, or safety

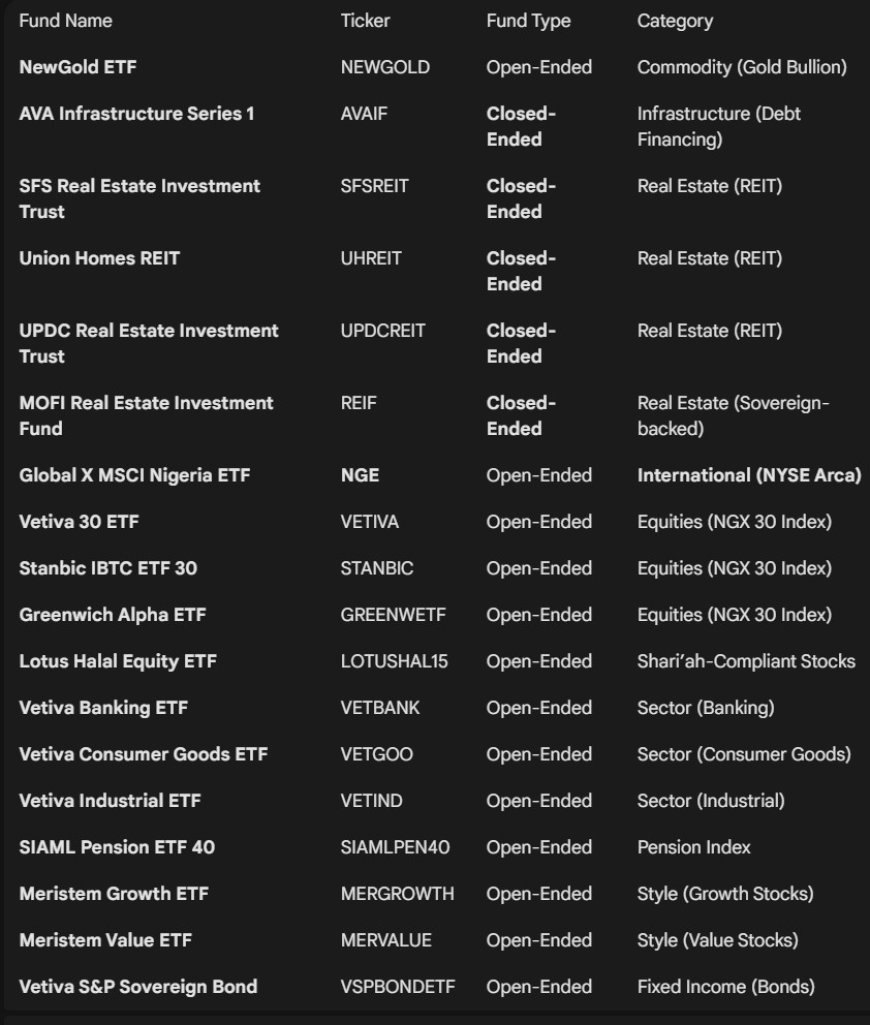

Let’s look at ETFs currently listed, based on the image you uploaded 👇

3. ETFs Available on the Nigerian Exchange (NGX)

A. Gold & Commodities

-

NewGold ETF (NEWGOLD) – Tracks gold prices (hedge against inflation)

B. Infrastructure & Real Estate

-

AVA Infrastructure Series 1 (AVAIF) – Infrastructure debt financing

-

SFS Real Estate Investment Trust (SFSREIT)

-

Union Homes REIT (UHREIT)

-

UPDC REIT (UPDCREIT)

-

MOFI Real Estate Investment Fund (REIF) – Sovereign-backed real estate

C. Broad Market & Index ETFs

-

Vetiva 30 ETF (VETIVA) – Tracks NGX 30

-

Stanbic IBTC ETF 30 (STANBIC) – NGX 30

-

Greenwich Alpha ETF (GREENWETF) – NGX 30

-

SIAML Pension ETF 40 (SIAMLPEN40) – Pension index

D. Sector ETFs

-

Vetiva Banking ETF (VETBANK) – Nigerian banks

-

Vetiva Consumer Goods ETF (VETGOODS)

-

Vetiva Industrial ETF (VETIND)

E. Style-Based ETFs

-

Meristem Growth ETF (MERGROWTH) – Growth stocks

-

Meristem Value ETF (MERVALUE) – Undervalued stocks

F. Shariah-Compliant ETF

-

Lotus Halal Equity ETF (LOTUSHAL15) – Ethical investing

G. Bond ETF

-

Vetiva S&P Sovereign Bond ETF (VSPBONDETF) – Government bonds

H. International Exposure

-

Global X MSCI Nigeria ETF (NGE) – Traded abroad, tracks Nigeria

So… Which ETF Has Performed Best Recently?

Performance changes year to year.

But generally:

-

Banking ETFs perform well during high interest rates

-

Bond ETFs perform well when rates fall

-

Gold ETFs protect against inflation

-

NGX 30 ETFs reflect the overall market

📌 Smart investors combine ETFs instead of choosing one.

4. How Do I Buy ETFs in Nigeria?

This part surprises many people.

Can I Buy ETFs Through My Stockbroker?

Yes.

If you can buy shares, you can buy ETFs.

Platforms You Can Use

You can buy ETFs through:

-

Traditional stockbrokers (licensed by the SEC Nigeria)

-

Investment apps connected to NGX( are the two best for now to get your ETF in Nigeria: Chaka, Afrinvest 2.0 )

📌 ETFs are bought the same way shares are bought.

Final Advice Before You Buy Any ETF

Before clicking “Buy, ask yourself:

❓ Am I investing short-term or long-term?

❓ Do I want safety, growth, or income?

❓ Can I stay calm if prices fall temporarily?

A Simple Rule

-

Want low stress & stability → Bond or Money Market ETFs

-

Want long-term growth → NGX 30 or Growth ETFs

-

Want inflation protection → Gold ETF

-

Want ethical investing → Halal ETF

Final Thought

If you understand:

-

ETFs

-

Risk

-

Diversification

-

Market cycles

You already know more than most Nigerians investing today.

And that puts you ahead, before you even buy your first ETF.