How to Compare Companies in the Same Sector

Learn how to compare companies in the same sector using revenue growth, profitability, debt, cash flow, and valuation to make smarter investment choices.

When investors see two companies in the same sector, they often ask:

“Which one is better?”

But comparing companies properly is not about picking favorites or following popularity.

It’s about understanding strength, efficiency, and long-term potential.

Let’s break this down step by step in simple language.

Why Comparing Companies Matters

Companies in the same sector:

-

Face similar economic conditions

-

Serve similar customers

-

Compete for the same money

So when one performs better than the other, there’s usually a reason.

Comparing companies helps you:

-

Avoid weak businesses

-

Spot industry leaders early

-

Invest with more confidence

Step 1: Make Sure They’re Truly in the Same Sector

Not all companies labeled “banking,” “telecom,” or “consumer goods” operate the same way.

Before comparing:

-

Confirm they sell similar products or services

-

Ensure they earn money in similar ways

-

Avoid comparing companies with very different business models

Comparison only works when businesses are comparable.

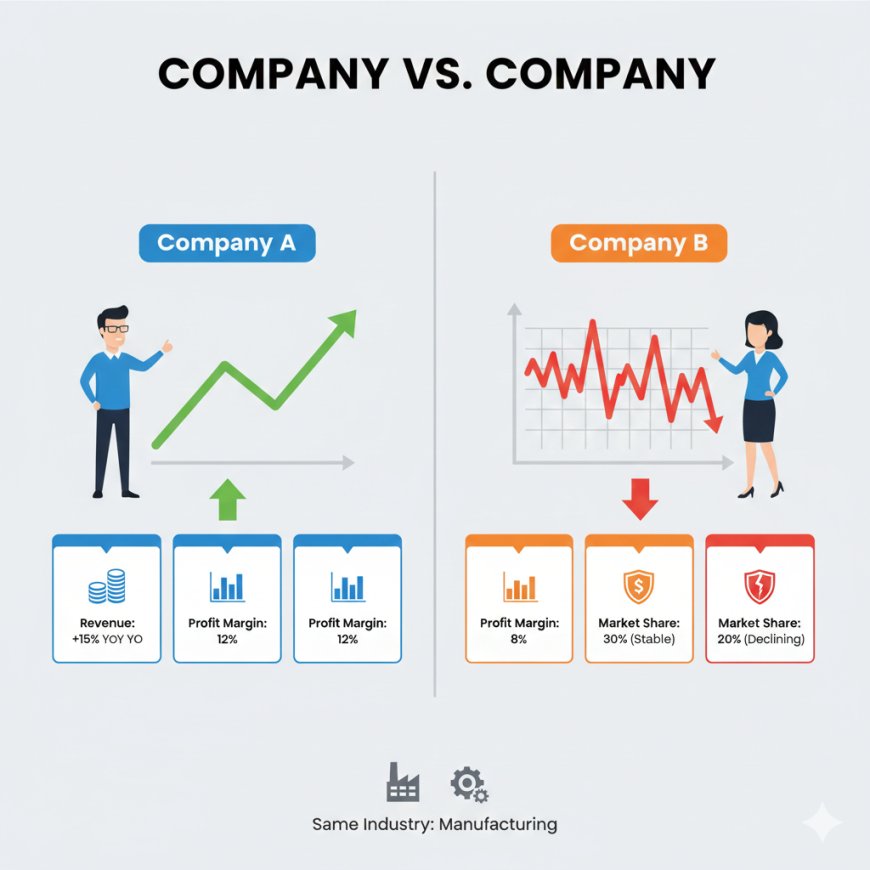

Step 2: Compare Revenue Growth

Revenue shows demand.

Ask:

-

Is revenue growing consistently?

-

Which company is growing faster?

-

Is growth steady or irregular?

A company with rising revenue is usually:

-

Gaining customers

-

Expanding market share

-

Doing something right

Flat or declining revenue is a warning sign.

Step 3: Compare Profitability

Revenue alone is not enough.

Profitability shows efficiency.

Check:

-

Net profit margin

-

Consistency of profits

-

Ability to remain profitable during tough times

A company that makes less revenue but higher profit may be better managed.

Step 4: Look at Costs and Expenses

Two companies can earn the same revenue but spend it very differently.

Compare:

-

Operating expenses

-

Cost control

-

Expense growth relative to revenue

A company that controls costs well can survive longer and grow stronger.

Step 5: Analyze Debt Levels

Debt can help growth, but too much debt weakens a business.

Compare:

-

Total debt

-

Debt-to-equity ratio

-

Ability to repay debt from cash flow

In the same sector, the company with manageable debt usually has more flexibility.

Step 6: Compare Cash Flow

Cash flow tells the truth.

Ask:

-

Is the company generating real cash?

-

Is cash flow improving over time?

-

Can the business fund itself without constant borrowing?

Strong cash flow means:

-

Stability

-

Ability to pay dividends

-

Freedom to expand

Step 7: Evaluate Market Position

Within the same sector:

-

One company is usually a leader

-

Others follow

Check:

-

Market share

-

Brand strength

-

Customer loyalty

Market leaders often:

-

Attract institutional investors

-

Withstand competition better

-

Recover faster after downturns

Step 8: Compare Valuation (Carefully)

Valuation answers:

“How much are investors paying for this company?”

Common metrics:

-

Price-to-Earnings (P/E)

-

Price-to-Book (P/B)

A cheaper company is not always better.

An expensive company may still be worth it if:

-

Growth is strong

-

Profits are reliable

-

Future prospects are clear

Always compare valuations within the same sector.

Nigerian Market Insight

In Nigeria:

-

Companies in the same sector can perform very differently

-

Management quality matters a lot

-

Cash flow and debt are especially important

Smart Nigerian investors:

-

Compare financial statements

-

Focus on consistency

-

Avoid emotional investing

Comparing companies in the same sector is not about finding the perfect company.

It’s about finding the strongest, healthiest, and most reliable option among peers.

When you compare properly, investing becomes calmer, clearer, and smarter.