How to Read Financial Terms & Conditions and Avoid Hidden Fees

Learn how to read financial terms and conditions, spot hidden fees, understand risks, and avoid costly financial mistakes before signing any agreement.

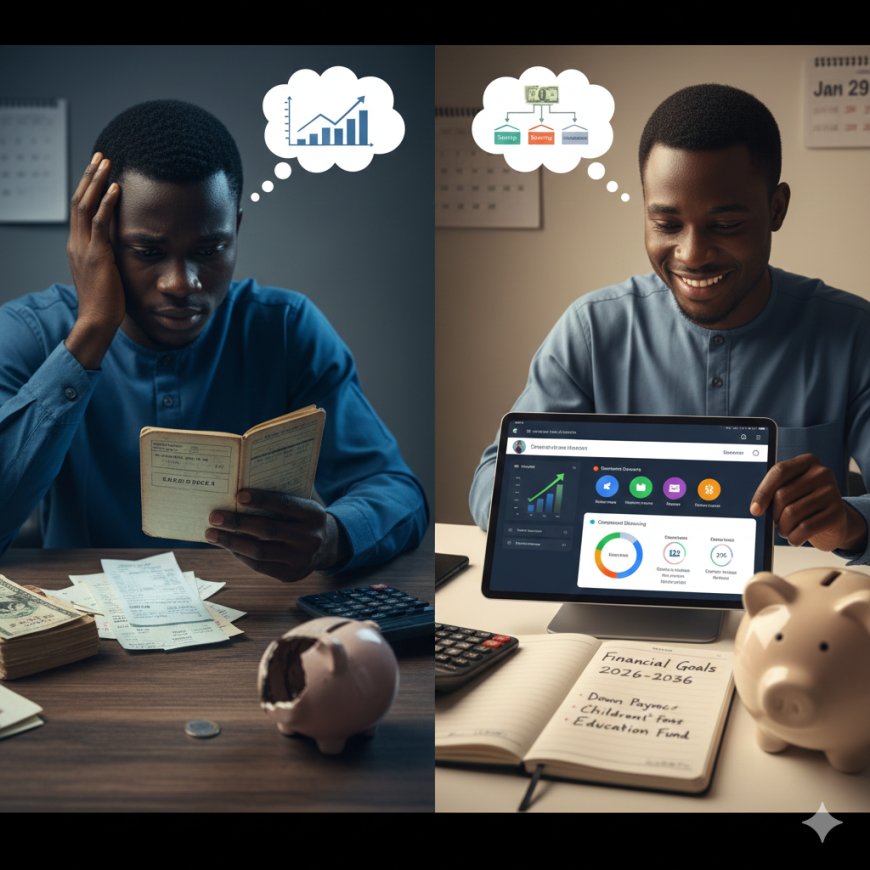

Many people don’t lose money because they are reckless; they lose money because they didn’t read the fine print.

From bank accounts to loan apps, investment platforms, insurance policies, and fintech tools, financial Terms & Conditions (T&C) quietly decide how much you pay, how much you earn, and who carries the risk.

If you don’t understand them, you can agree to rules that work against you, legally.

This guide will show you how to read financial Terms & Conditions the smart way, even if you’re a complete beginner.

What Are Financial Terms & Conditions?

Financial Terms & Conditions are the legal rules that govern your relationship with a financial institution or platform.

They explain:

-

Your rights and limitations

-

The company’s powers and responsibilities

-

Fees, penalties, and interest

-

What happens when something goes wrong

Once you click “I Agree”, you are legally bound even if you didn’t read it.

Why Reading Financial Terms & Conditions Matters

Ignoring T&C can lead to:

-

Hidden charges are draining your money

-

Unexpected interest rates

-

Locked funds you can’t access

-

Penalties you didn’t plan for

-

Loss of money with no legal protection

Reading them protects your money, peace of mind, and future.

Step 1: Focus on the Most Important Sections

You don’t need to read every word. Instead, focus on these critical areas.

1. Fees & Charges

This section tells you how the company makes money from you.

Look for:

-

Account maintenance fees

-

Transaction or transfer fees

-

Withdrawal charges

-

Penalty fees

⚠️ Danger words to watch out for:

-

“May charge”

-

“Subject to change”

-

“At our discretion.”

These mean fees can increase at any time.

2. Interest Rates (Loans & Investments)

Never focus only on monthly payments.

Check:

-

Interest rate (fixed or variable)

-

How interest is calculated (daily, monthly, annually)

-

Total repayment amount

Many borrowers fall into trouble because they ignore the total cost of the loan.

3. Penalties, Defaults & Late Payments

This section explains what happens if:

-

You missed a payment

-

You delay repayment

-

Your account becomes inactive

Ask yourself:

“If something goes wrong, how bad can this get?”

High penalties can turn a small mistake into a financial crisis.

4. Withdrawal Rules & Lock-In Periods

Very important for:

-

Investment platforms

-

Fixed deposits

-

Savings apps

Check:

-

Can you withdraw anytime?

-

Is there a penalty for early withdrawal?

-

How long does it take to receive your money?

Money you can’t access when needed is not truly your money.

5. Risk Disclosure Statements

This section protects the company, not you.

Common phrases include:

-

“Past performance is not a guarantee of future returns.”

-

“You may lose part or all of your capital.”

-

“We are not responsible for market losses.”

This tells you who bears the risk, usually the customer.

Step 2: Beware of These Dangerous Phrases

Slow down immediately when you see:

-

“We reserve the right to…”

-

“Without prior notice.”

-

“At our sole discretion.”

-

“Not liable for losses.”

These phrases give the company maximum power and limit your protection.

Step 3: Ask These 5 Smart Questions Before Agreeing

Before accepting any financial Terms & Conditions, ask yourself:

-

How does this company make money from me?

-

What is the worst-case scenario?

-

Can fees or interest increase later?

-

How easily can I exit or withdraw my money?

-

Who is responsible if I lose money?

If the answers are unclear, don’t proceed yet.

Step 4: Never Let Urgency Pressure You

Bad financial products thrive on urgency:

-

“Limited-time offer”

-

“Act now”

-

“Last chance today.”

Legitimate financial opportunities give you time to think.

A Simple Rule to Remember

If you don’t understand it, don’t sign it.

If you can’t explain it, don’t invest in it.

Reading financial Terms & Conditions isn’t about being paranoid

It’s about being financially intelligent.

The wealthy read the fine print.

The poor skip it.

And that small habit creates a massive difference over time.

Want to Learn More?

At HappyInvest, we simplify money, investing, and wealth creation so anyone, beginner or advanced, can make smarter financial decisions.

==> Explore more financial literacy guides on happyinvest.ng