How to Build Generational Wealth Without Working Harder

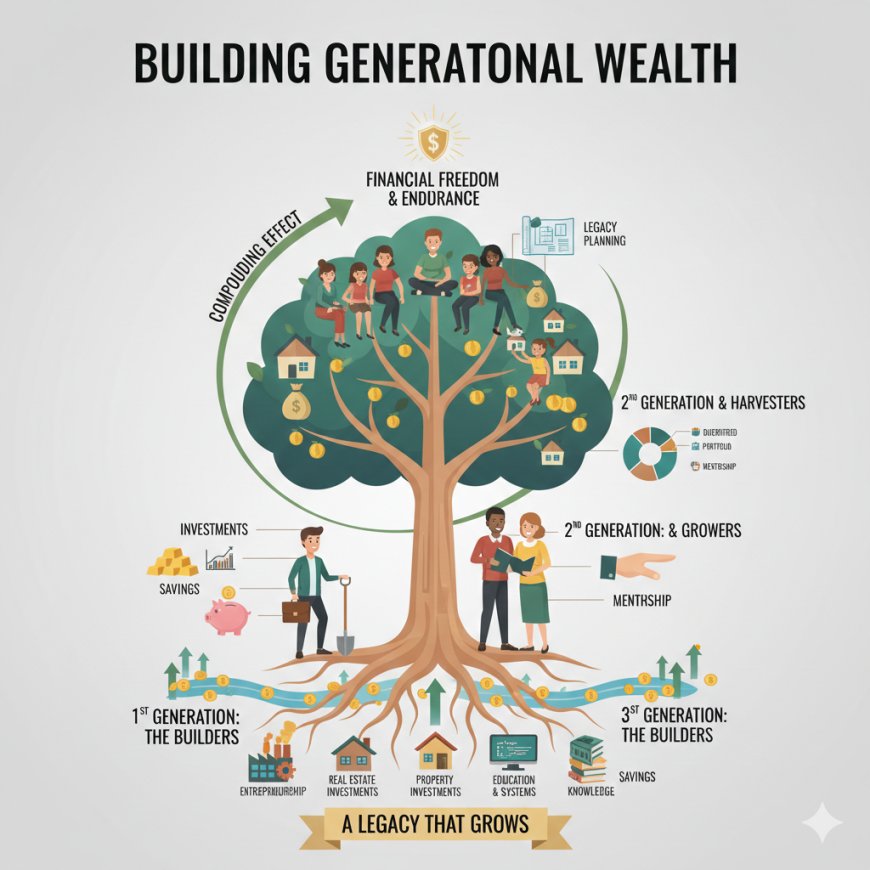

Learn how to build generational wealth without working harder by owning assets, creating systems, leveraging other people’s time, and investing in appreciating assets.

Most people believe generational wealth is built by working harder, longer hours, and sacrificing everything.

That belief is wrong.

Hard work can help you survive, but it rarely helps you build generational wealth.

Generational wealth is not built with effort alone.

It is built with ownership, systems, leverage, and long-term thinking.

Your time is limited.

Your impact shouldn’t be.

Let’s break this down simply.

What Generational Wealth Really Means

Generational wealth is money, assets, and opportunities that:

-

Outlive you

-

Support your children and future generations

-

Continue growing without your daily effort

It’s not just about being rich.

It’s about creating something that keeps working even when you stop.

1. Owning Assets, Not Just Earning Income

Income pays bills.

Assets build wealth.

An asset is anything that:

-

Puts money in your pocket

-

Grows in value over time

-

Works without your constant presence

Examples include:

-

Businesses

-

Stocks and shares

-

Real estate

-

Royalties

-

Intellectual property

Employees trade time for money.

Asset owners separate income from time.

This is the foundation of generational wealth.

2. Creating Systems That Run Without You

A system is a repeatable process that produces results with or without your direct effort.

Generational wealth comes from systems like:

-

Businesses with structure

-

Automated investments

-

Processes that others can run

-

Scalable models

If everything depends on you showing up daily, it’s not wealth; it’s a job.

Systems turn effort into long-term value.

3. Leveraging Other People’s Time

There are only 24 hours in a day.

You cannot build generational wealth alone.

Wealthy people grow faster because they:

-

Delegate tasks

-

Build teams

-

Use employees, partners, and technology

-

Multiply effort through people

This is not exploitation.

It’s organization and leadership.

When 10 people contribute to a system, results multiply, while your time stays free.

4. Building Intellectual Property

Intellectual property (IP) is one of the most powerful tools for generational wealth.

Examples include:

-

Books

-

Online courses

-

Software

-

Content platforms

-

Brands

-

Licensing rights

You create IP once, and it can:

-

Earn repeatedly

-

Be sold globally

-

Be passed down

-

Scale without limits

This is how creators, founders, and educators build wealth that lasts beyond them.

5. Investing in Things That Appreciate

Generational wealth grows through appreciation, not consumption.

Appreciating assets include:

-

Strong businesses

-

Quality stocks

-

Land and property

-

Well-managed funds

Depreciating items:

-

Lose value

-

Consume money

-

Create no future income

People who build generational wealth:

-

Delay gratification

-

Invest consistently

-

Think long-term

-

Allow compounding to work

Time is the secret ingredient.

6. Shifting From Labor to Ownership

The biggest shift is mental.

Instead of asking:

“How can I earn more?”

Ask:

“What can I own that grows over time?”

Ownership changes everything:

-

Risk profile

-

Income potential

-

Legacy

Hard work may start the journey, but ownership finishes it.

The Nigerian Reality

In Nigeria:

-

Inflation reduces cash value

-

Income alone is unstable

-

Passing wealth intentionally matters

Generational wealth here requires:

-

Asset ownership

-

Education

-

Discipline

-

Long-term investing mindset

The earlier you start, the more powerful compounding becomes.

Generational wealth is not built by exhaustion.

It’s built by:

-

Owning assets

-

Creating systems

-

Leveraging people and technology

-

Building intellectual property

-

Investing in appreciating assets

Your time is limited.

But if you build wisely, your impact won’t be.