Mutual Funds in Nigeria: Best Funds, Types, and How to Invest as a Student or Salary Earner

Learn what mutual funds are, the best mutual funds to invest in Nigeria, how students and salary earners can start with as little as ₦5,000, and the best apps to buy mutual funds safely in 2025.

Investing in Nigeria can feel confusing, especially if you’re a student or a salary earner trying to grow money in an economy affected by inflation and rising living costs. This is where mutual funds come in.

Mutual funds allow you to invest small amounts, earn competitive returns, and let professionals manage your money without needing deep financial knowledge.

In this guide, you’ll learn:

-

What mutual funds are

-

The best mutual funds in Nigeria

-

The 4 types of mutual funds and when to invest in each

-

How inflation and interest rates affect them

-

How students and salary earners can start investing

-

The best apps to buy mutual funds in Nigeria

What Is a Mutual Fund?

A mutual fund is an investment vehicle where money from many investors is pooled together and invested by a professional fund manager into assets such as:

-

Treasury bills

-

Bonds

-

Stocks

-

Money market instruments

- Bank Placement

Instead of investing alone, you own a portion of a large, diversified portfolio.

Simple explanation:

You contribute money → professionals invest it → you earn returns.

What Are Mutual Funds in Nigeria?

Mutual funds in Nigeria are SEC-regulated and managed by licensed asset management firms such as:

-

Stanbic IBTC Asset Management

-

ARM Investment Managers

-

Chapel Hill Denham( Invest Naija )

-

United Capital

-

FBNQuest

-

Afrinvest

- Cowrywise

These funds invest in Nigerian financial instruments and are designed to suit different risk levels and time horizons.

What Is Meant by Mutual Funds? (Beginner Explanation)

Mutual funds mean:

-

You don’t need millions to invest

-

You don’t need to monitor the stock market daily

-

Your money is diversified automatically

They are ideal for:

-

Beginners

-

Busy professionals

-

Students

-

Anyone who wants structured investing

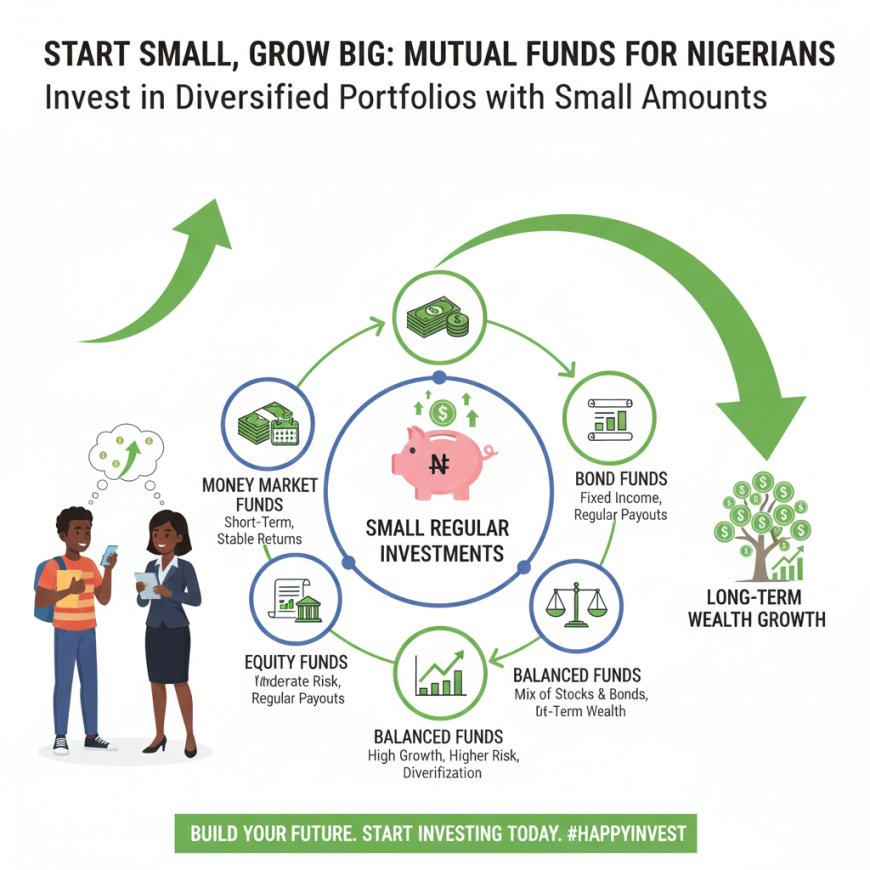

What Are the 4 Types of Mutual Funds?

1. Money Market Funds (MMF)

What they invest in:

Treasury bills, fixed deposits, commercial papers, and short-term government securities.

Best for:

-

Students

-

Salary earners

-

Emergency funds

-

Short-term goals

Risk: Very low

Returns: Stable and predictable ( Your Capital is fixed, but your daily returned changes depending on the inflation Rate )

Effect of inflation & interest rates:

-

Perform well when interest rates are high and reduce as the inflation rate comes down

-

Protect capital better than savings accounts

Best time to invest: Anytime

2. Fixed Income / Bond Funds

What they invest in:

Government and corporate bonds.

Best for:

-

Salary earners

-

Conservative investors

-

Medium to long-term planning

Risk: Low to medium

Returns: Higher than money market funds

Effect of inflation & interest rates:

-

Best when interest rates peak and start declining

-

Inflation can reduce real returns if unmanaged

Best time to invest: When rates are high, and it is tax-free

3. Equity Funds

What they invest in:

Shares of Nigerian companies.

Best for:

-

Students and young investors

-

Long-term wealth builders

Risk: High

Returns: High (long term)

Effect of inflation & interest rates:

-

Best hedge against inflation over time

-

Short-term volatility during economic downturns

Best time to invest: During market dips or crashes

4. Balanced / Hybrid Funds

What they invest in:

A mix of equities, bonds, and money market instruments.

Best for:

-

Beginners

-

Salary earners

-

Investors who want balance

Risk: Medium

Returns: Moderate and stable

Effect of inflation & interest rates:

-

Performs reasonably well across different cycles

Best time to invest: Anytime

Best Mutual Funds to Invest in Nigeria (Examples)

This list is for education, not financial advice.

Money Market Funds

-

Stanbic IBTC Money Market Fund

-

ARM Money Market Fund

-

United Capital Money Market Fund

Bond / Fixed Income Funds

-

FBNQuest Fixed Income Fund

-

ARM Bond Fund

-

United Capital Bond Fund

Equity Funds

-

Stanbic IBTC Equity Fund

-

Afrinvest Equity Fund

Balanced Funds

-

ARM Balanced Fund

-

Stanbic IBTC Balanced Fund

Which Mutual Fund Is the Best in Nigeria?

There is no one-size-fits-all “best” mutual fund.

The best mutual fund depends on:

-

Your income

-

Your age

-

Your risk tolerance

-

Your financial goals

General guide:

-

Students: Money Market + small Equity exposure

-

Salary earners: Money Market + Bond + Balanced

-

Long-term investors: Equity + Balanced

How to Invest in Mutual Funds in Nigeria

Step 1: Choose an Investment App

Popular SEC-regulated platforms include:

-

InvestNaija

-

Stanbic IBTC Invest App

-

Afrinvest 2.0

-

I-Invest

-

Bamboo (for global exposure)

Step 2: Open an Account

You’ll need:

-

BVN

-

Valid ID

-

Bank details

Step 3: Select a Mutual Fund

Choose based on:

-

Risk level

-

Investment goal

-

Minimum investment

Step 4: Start Small and Be Consistent

Many funds allow starting from:

-

₦5,000

-

₦10,000

Consistency matters more than amount.

How to Buy Mutual Funds in Nigeria

You can buy mutual funds through:

-

Asset managers’ apps

-

Licensed stockbroker platforms

-

Investment apps partnered with fund managers

Process:

-

Search for the fund

-

Enter investment amount

-

Confirm transaction

Mutual Funds for Students vs Salary Earners

Students

-

Focus on Money Market Funds

-

Add Equity Funds gradually

-

Invest monthly

-

Build discipline early

Salary Earners

-

Emergency fund in Money Market

-

Wealth Preservation with Bond Funds

-

Growth via Equity Funds

-

Automate monthly contributions

Why Mutual Funds Are a Smart Choice in Nigeria

Mutual funds help you:

-

Invest with small capital

-

Reduce risk through diversification

-

Earn steady returns

-

Build long-term wealth consistently

Whether you earn ₦40,000 or ₦400,000 monthly, mutual funds give you a structured and realistic path to financial growth.

👉 Which type of mutual fund fits your current income level—student or salary earner?