Budgeting and Saving: The Foundation of Smart Investing in Nigeria

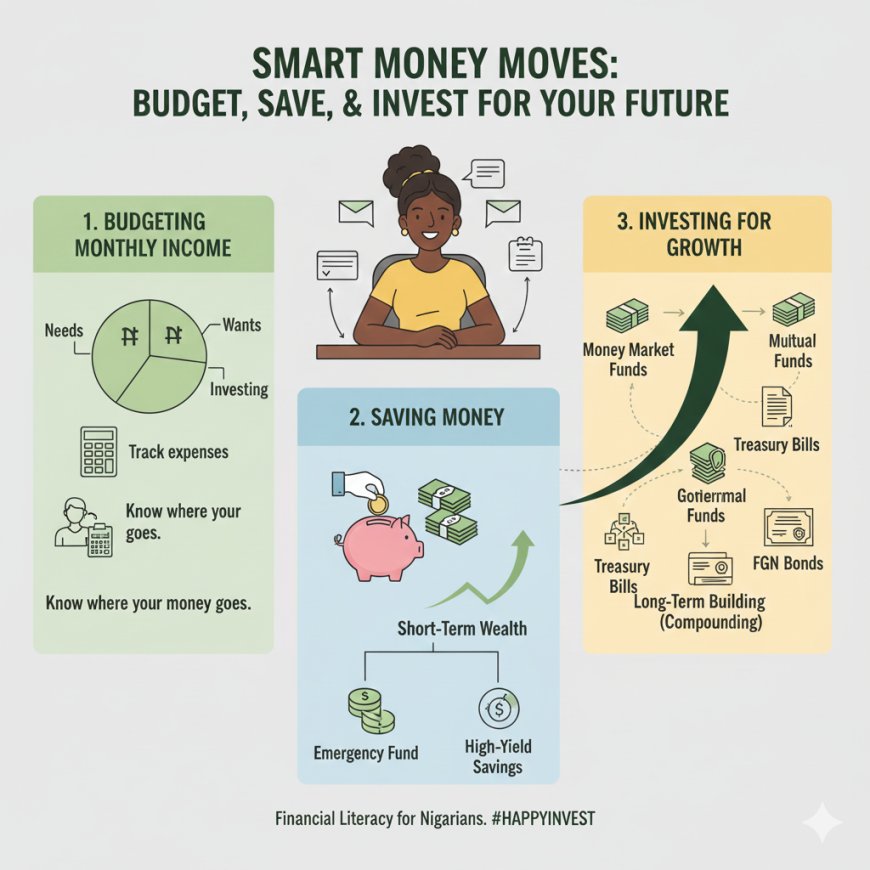

Budgeting and saving are the foundation of successful investing. This article explains how Nigerians can use budgeting to save smarter and invest safely using Money Market Funds, mutual funds, Treasury Bills, FGN bonds, commercial papers, and other fixed-income investments for both short- and long-term goals.

Most Nigerians want to invest.

But many skip the most important step.

👉 Budgeting and saving.

You cannot invest what you don’t control.

And you cannot grow money you don’t keep.

Before stocks, before crypto, before real estate

Budgeting and saving come first.

Let’s break it down in a simple, practical way.

1. Why Budgeting Is the First Step to Investing

Budgeting simply means:

Telling your money where to go instead of wondering where it went.

Many people earn money, but:

-

Don’t know how much comes in

-

Don’t know how much goes out

-

Don’t know what is left

That’s why money finishes fast.

Simple Nigerian Example

If you earn ₦100,000 monthly:

-

Data

-

Transport

-

Food

-

Subscriptions

-

Small enjoyment

Without a budget, everything disappears.

But with a budget:

-

You can save

-

You can invest

-

You can plan

2. Saving Is Not the Same as Investing (But Both Are Important)

Saving:

-

Protects your money

-

Keeps it available

-

Low risk

Investing:

-

Grows your money

-

Beats inflation

-

Long-term focus

📌 Smart Nigerians save first, then invest wisely.

3. Where Saving Meets Investing: Fixed-Income Investments

If you don’t like stress, market noise, or price swings,

Fixed-income investments are your friend.

These are investments that:

-

Pay predictable returns

-

Are safer than stocks

-

Works well for short- and medium-term goals

Let’s explain them simply.

4. Money Market Fund (MMF): The Easiest Place to Start

A Money Market Fund is a type of mutual fund that invests in:

-

Treasury Bills

-

Bank placements

-

Commercial papers

Why Nigerians Love MMFs

-

Low risk

-

Daily interest

-

Easy withdrawal

-

Better returns than savings accounts

Example

You save ₦50,000 in a Money Market Fund.

Instead of sleeping in your bank account,

It earns interest every day.

📌 MMFs are great for:

-

Emergency funds

-

Short-term savings

-

Parking cash while planning investments

5. Mutual Funds: One Pot, Many Investments

A Mutual Fund is when:

-

Many people contribute money

-

A professional manager invests it

-

Everyone shares the returns

Types of Mutual Funds in Nigeria:

-

Money Market Fund (safest)

-

Bond Fund

-

Equity Fund

-

Balanced Fund

📌 Money Market Fund is NOT separate from mutual funds.

It is the safest type of mutual fund.

6. Treasury Bills (T-Bills): Government Short-Term Loans

Treasury Bills are:

-

Short-term loans to the Nigerian government

-

Usually 91, 182, or 364 days

Why T-Bills Matter

-

Very low risk

-

Backed by the government

-

Fixed returns

They are good for:

-

Conservative investors

-

Short-term planning

-

Capital protection

7. FGN Bonds: Long-Term Stability

FGN Bonds are:

-

Long-term government investments

-

Pay fixed interest (coupon)

-

Usually lasts several years

- Can be used to collecta loan from the bank ( collateral ) faster than using land

Why Bonds Are Powerful

-

Predictable income

-

Stable returns

-

Good hedge when inflation falls

- Tax-free investment, while others have a 10% tax from 2026

📌 Bonds are better for:

-

Long-term goals

-

Retirement planning

-

Wealth preservation

8. Commercial Papers: Higher Return, Slightly Higher Risk

Commercial Papers are:

-

Short-term loans to big companies

-

Higher interest than T-Bills

-

Slightly higher risk

They are usually used by:

-

Experienced investors

-

Institutions

-

People with good risk understanding

9. Short-Term vs Long-Term Fixed Investments

Short-Term (0–1 year)

-

Money Market Funds

-

Treasury Bills

-

Some Commercial Papers

Used for:

-

Emergency funds

-

Upcoming expenses

-

Safety

Long-Term (3+ years)

-

FGN Bonds

-

Bond Mutual Funds

-

Balanced Funds

Used for:

-

Wealth building

-

Stability

-

Future planning

10. A Simple Nigerian Budgeting + Investing Strategy

Let’s say you earn ₦100,000 monthly.

A simple rule:

-

60% → Living expenses

-

20% → Saving / MMF

-

20% → Investing (stocks, ETFs, bonds)

Even if your income is smaller, the habit matters more than the amount.

Final Thoughts

Budgeting gives you control.

Saving gives you security.

Investing gives you growth.

You don’t need to rush into risky investments.

Start with:

-

Money Market Funds

-

Mutual Funds

-

T-Bills

-

Bonds

As you grow, you can add:

-

Stocks

-

ETFs

-

Other assets

📌 The goal is not quick money.

📌 The goal is steady progress.

If your money is not working,

it is losing value quietly.

Start budgeting.

Start saving.

Start investing one step at a time.