How to Build My Nigeria + US Retirement Portfolio

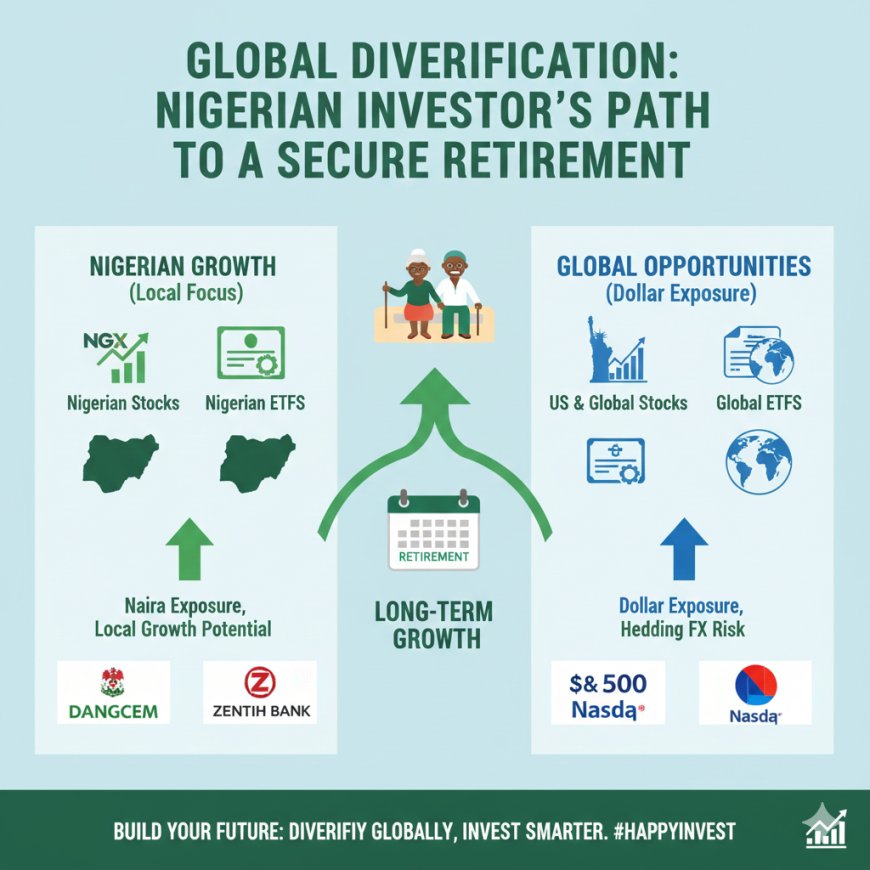

A practical guide to building a diversified Nigeria and US retirement portfolio. Learn how to combine Nigerian stocks, ETFs, bonds, and money market funds with US and global ETFs to grow wealth, protect against inflation, and secure long-term financial freedom.

Below is a practical Nigeria + US retirement portfolio, written in a simple, realistic way that works whether you’re a student, salary earner, or young professional in Nigeria.

No hype. Just how real retirement money is built.

Retirement money should do three things:

1️⃣ Grow

2️⃣ Pay you

3️⃣ Protect you from inflation & Nigeria risk

That’s why mixing Nigeria + US investments is powerful.

1. Core Principles Behind This Portfolio

✔ Long-term (10–30 years)

✔ Diversified across countries

✔ Combines growth + income

✔ Simple to manage

✔ Works with small monthly amounts

2. Portfolio Structure (Big Picture)

| Asset Class | Nigeria | USA / Global |

|---|---|---|

| Growth | Stocks, ETFs | ETFs (S&P 500, Tech, AI) |

| Income | Dividends, Bonds | Dividend ETFs, Bonds |

| Stability | MMF, T-bills | Bond ETFs |

| Hedge | REITs, Gold ETFs | Gold, Crypto ETFs |

3. Recommended Allocation (Young Investor: 20–35 yrs)

Total Portfolio = 100%

| Category | Allocation |

|---|---|

| Nigeria Investments | 45% |

| US & Global Investments | 45% |

| Safety / Cash Buffer | 10% |

4. Nigeria Retirement Portfolio (45%)

1. Nigerian Stocks & ETFs – 25%

Purpose: Growth + dividends

Examples:

-

NGX 30 ETF (Vetiva / Stanbic)

-

Banking ETF (VETBANK)

-

Blue-chip stocks: Zenith Bank, GTCO, MTN

📌 Why?

-

Long-term growth

-

Dividend income

-

Exposure to Nigerian economy

2. Bonds & Fixed Income – 15%

Purpose: Stability + predictable income

Examples:

-

FGN Bonds

-

Bond ETFs (VSPBONDETF)

-

Corporate bonds

📌 Why?

-

Fixed returns

-

Less volatile than stocks

-

Good for retirement income later

3. Money Market Fund – 5%

Purpose: Liquidity & safety

Examples:

-

Zenith MMF

-

Stanbic MMF

-

ARM MMF

📌 Why?

-

Emergency buffer

-

Capital preservation

-

Easy withdrawals

US & Global Retirement Portfolio (45%)

4. Broad Market ETFs – 20%

Purpose: Long-term global growth

Examples:

-

S&P 500 ETF

-

Total US Market ETF

📌 Why?

-

Dollar-based returns

-

Beats inflation long-term

-

Strong global companies

5. Sector & Future ETFs – 15%

Purpose: High-growth exposure

Examples:

-

AI ETFs

-

Semiconductor ETFs

-

Technology ETFs

-

Blockchain / Digital asset ETFs

📌 Why?

-

Exposure to future industries

-

Higher growth potential over decades

6. Dividend & Bond ETFs – 10%

Purpose: Income + stability

Examples:

-

US Dividend ETFs

-

Bond ETFs

📌 Why?

-

Dollar income

-

Portfolio balance

-

Retirement cash flow later

Safety & Hedge (10%)

7. Inflation & Risk Hedge – 10%

Examples:

-

Gold ETFs

-

REIT ETFs

-

Small crypto exposure (BTC / ETH ETFs)

📌 Why?

-

Hedge against inflation

-

Hedge against currency risk

-

Long-term store of value

How Much Should You Invest Monthly?

Example Plans:

| Monthly Amount | How to Split |

|---|---|

| ₦5,000 | NGX ETF + MMF |

| ₦10,000 | NGX ETF + Bond + US ETF |

| ₦25,000 | Full Nigeria + US split |

| ₦50,000+ | Proper diversification |

📌 Start small. Increase as income grows.

Rebalancing Rule (Very Important)

Once a year:

-

Reduce what grew too much

-

Add to what fell behind

-

Keep your original percentages

This is how professionals manage retirement portfolios.

❌ Mistakes to Avoid

❌ Putting everything in Nigeria

❌ Chasing only high returns

❌ Ignoring dollar investments

❌ Panic selling during market drops

❌ Touching retirement money

Simple Truth About Retirement Wealth

Retirement wealth is not built by:

-

Luck

-

Gambling

-

One hot stock

It’s built by:

✔ Consistency

✔ Time

✔ Compounding

✔ Discipline

Final Advice

If you:

-

Start early

-

Invest monthly

-

Diversify Nigeria + US

-

Stay patient

👉 Your retirement will take care of itself.

The market rewards discipline, not noise.