How to Read a Company’s Financial Statements (Beginner-Friendly Guide)

Understanding a company’s financial statements is the foundation of smart investing. This beginner-friendly guide explains the income statement, balance sheet, and cash flow statement in simple terms, helping students and new investors make informed stock investment decisions in Nigeria and globally.

Many people buy stocks based on rumors, social media hype, or “my friend said so.”

Smart investors do something different: they read a company’s financial statements.

Financial statements tell you:

-

How much a company earns

-

How much does it owes

-

Whether it is growing or struggling

The good news?

You don’t need to be an accountant to understand them.

This guide breaks everything down step by step and in simple terms.

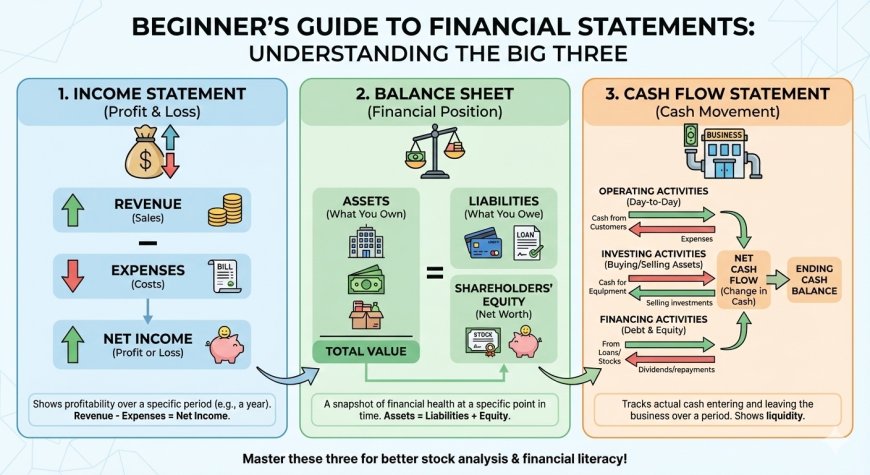

What Are Financial Statements?

Financial statements are official reports that show a company’s financial health.

Public companies release them every quarter and every year.

There are three main financial statements you must know:

1. Income Statement

2. Balance Sheet

3. Cash Flow Statement

Let’s explain each one clearly.

1. Income Statement (Profit & Loss Statement)

The income statement answers one main question:

Is the company making money or losing money?

Key Things to Look At

Revenue (Sales)

This is the total money the company made from selling its products or services.

📌 Example:

If a company sells phones and makes ₦10 billion from sales, that is its revenue.

Good sign: Revenue is growing every year.

Expenses

These are the costs of running the business:

-

Salaries

-

Rent

-

Production costs

-

Marketing

Net Profit (Bottom Line)

This is what remains after all expenses are paid.

📌 Simple formula:

Revenue – Expenses = Net Profit

Good sign:

-

Consistent profits

-

Profit is growing over time

🚩 Warning sign:

-

Continuous losses

-

Profits are going down yearly

2. Balance Sheet (What the Company Owns & Owes)

The balance sheet shows the company’s financial position at a specific point in time.

It answers this question:

Is the company financially strong or drowning in debt?

Assets

What the company owns:

-

Cash

-

Buildings

-

Equipment

-

Inventory

Liabilities

What the company owes:

-

Loans

-

Debts

-

Unpaid bills

Shareholders’ Equity

This belongs to the owners (shareholders).

📌 Simple formula:

Assets = Liabilities + Equity

What to Watch

✅ More assets than liabilities

🚩 Too much debt compared to assets

A company with heavy debt struggles during economic downturns.

3. Cash Flow Statement (Actual Cash Movement)

This is one of the most important statements.

It answers:

Is real cash entering or leaving the business?

A company can show profits on paper but still be broke in reality.

Three Types of Cash Flow

1. Operating Cash Flow

Cash from the main business operations.

✅ Very important

Positive operating cash flow means the business can sustain itself.

2. Investing Cash Flow

Cash is used to buy assets or investments.

📌 Example: Buying machines or buildings.

Negative here is not always bad; it can mean growth.

3. Financing Cash Flow

Cash from loans, investors, or dividend payments.

Simple Checklist for Beginners

Before buying any stock, ask:

✅ Is revenue growing?

✅ Is the company profitable?

✅ Does it have manageable debt?

✅ Is operating cash flow positive?

If most answers are YES, the company is likely healthy.

Where Can You Find Financial Statements?

-

Company annual reports

-

Stock exchange websites (NGX, NASDAQ, NYSE)

-

Investment platforms

-

Company investor relations pages

Common Beginner Mistakes

🚫 Buying stocks based on hype

🚫 Ignoring debt levels

🚫 Focusing only on profit, not cash flow

🚫 Not comparing results over several years

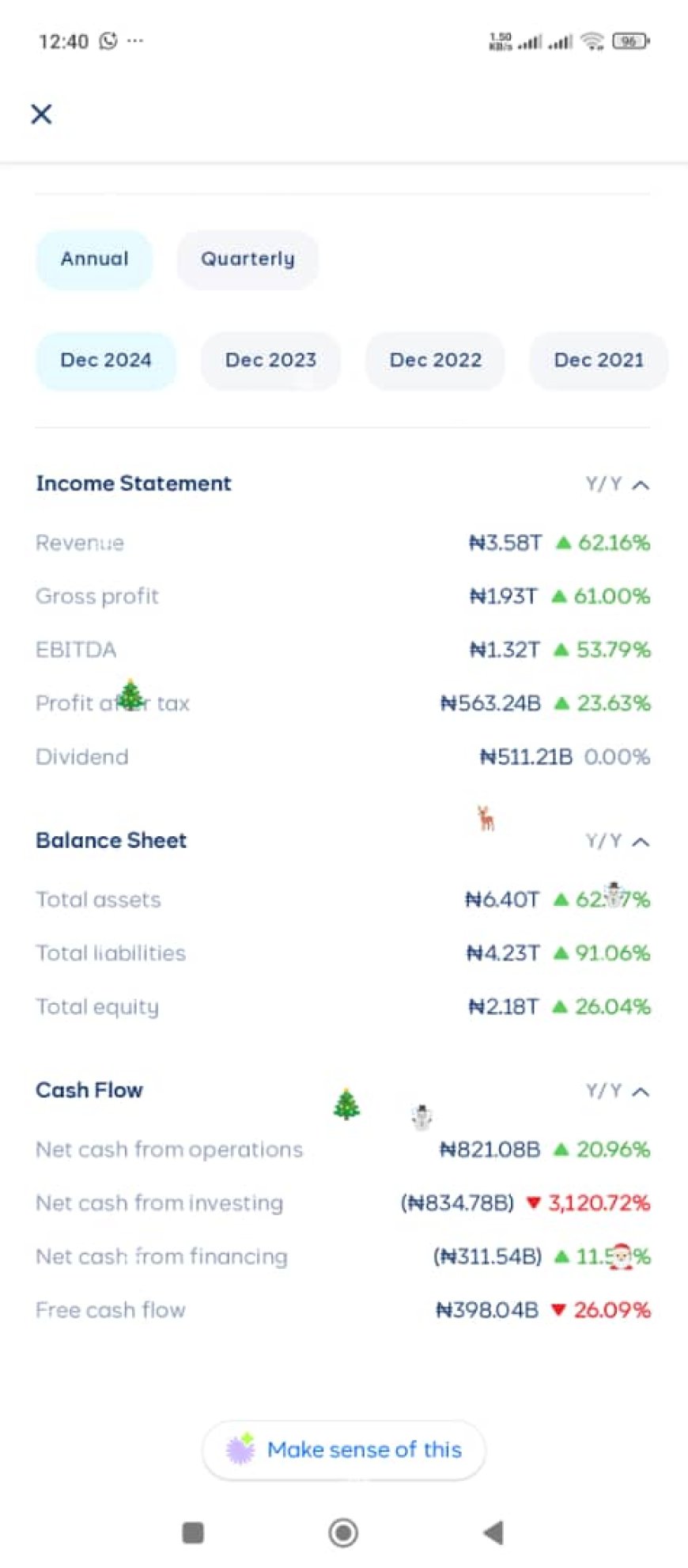

Nigerian Company Case Study

How to Read Financial Statements Using Dangote Cement (Simple Guide)

If you want to learn how to read financial statements, the best way is to use a real Nigerian company.

Let’s use Dangote Cement Plc: one of the biggest and most well-known companies on the Nigerian Exchange (NGX).

⚠️ Note: Figures are simplified for learning. Always check the latest annual report before investing.

Step 1: Understanding the Business

Before numbers, understand what the company does.

Dangote Cement:

-

Produces and sells cement

-

Operates in Nigeria and other African countries

-

Benefits from infrastructure, housing, and population growth

📌 Rule:

Never invest in a business you don’t understand.

Step 2: Income Statement Analysis (Is the Company Profitable?)

Revenue (Sales)

Dangote Cement generates revenue mainly from:

-

Cement sales in Nigeria

-

Exports and African operations

What to look for:

-

Is revenue growing year after year?

-

Is growth steady or unstable?

✅ Dangote Cement has shown consistent revenue growth, supported by demand for construction.

Expenses

Major expenses include:

-

Energy (gas, diesel)

-

Transportation

-

Staff costs

📌 Rising energy costs can reduce profit margins — something investors must monitor.

Net Profit

Net profit shows what remains after all expenses.

✅ Dangote Cement has remained profitable, even during tough economic periods.

Investor lesson:

A consistently profitable company is usually more resilient.

Step 3: Balance Sheet Analysis (Is the Company Financially Strong?)

Assets

Dangote Cement owns:

-

Cement plants

-

Equipment

-

Cash and receivables

These assets give it a competitive advantage.

Liabilities

Includes:

-

Loans

-

Payables

-

Bonds

📌 Cement companies are capital-intensive, so some debt is normal.

What matters:

👉 Can the company comfortably service its debt?

Equity

Shareholders’ equity shows how much truly belongs to investors.

✅ Strong equity base = financial stability.

Step 4: Cash Flow Statement (Is Cash Really Coming In?)

This is where many beginners make mistakes.

Operating Cash Flow

Dangote Cement generates strong positive cash flow from operations.

✅ This means:

-

The business funds itself

-

It can pay dividends

-

It can expand without borrowing excessively

Investing Cash Flow

Often negative due to:

-

Expansion

-

New plants

-

Equipment upgrades

📌 Negative investing cash flow is not bad if the operating cash flow is strong.

Financing Cash Flow

Includes:

-

Loan repayments

-

Dividends to shareholders

Dangote Cement has a history of dividend payments, which attracts long-term investors.

Step 5: Key Ratios (Beginner Level)

Profit Margin

Shows how much profit is made from each naira of sales.

✅ Higher margins 📈 = efficient business.

Debt-to-Equity Ratio

Shows how much debt the company uses compared to shareholders’ money.

📌 Moderate debt is okay; too much is risky.

Earnings Per Share (EPS)

Shows profit allocated to each share.

✅ Growing EPS is a strong positive signal.

Step 6: Red Flags to Watch

🚩 Rising costs without revenue growth

🚩 Excessive debt

🚩 Declining cash flow

🚩 Heavy reliance on borrowing

No company is perfect. Investing is about managing risk, not avoiding it.

Step 7: Final Investment Lesson

What Dangote Cement Teaches Beginners:

✔ Understand the business first

✔ Check profit consistency

✔ Analyze debt carefully

✔ Focus on cash flow, not hype

✔ Look long-term, not daily price moves

This image was obtained from my Cowrywise account. You can download it, and it is going to help you quickly go throught stocks financial statements.

Beginner Summary

If you can understand this case study, you can analyze:

-

Nigerian banks

-

Telecom companies

-

Consumer goods stocks

-

Even US stocks

📘 Financial statements are the language of investing. Learn the language, and money will follow.

Final Thoughts

Learning how to read financial statements gives you a huge advantage as an investor.

You don’t need to understand everything at once.

Start small:

-

Learn the basics

-

Practice with real companies

-

Improve over time

📈 Smart investing is not gambling, it’s informed decision-making.