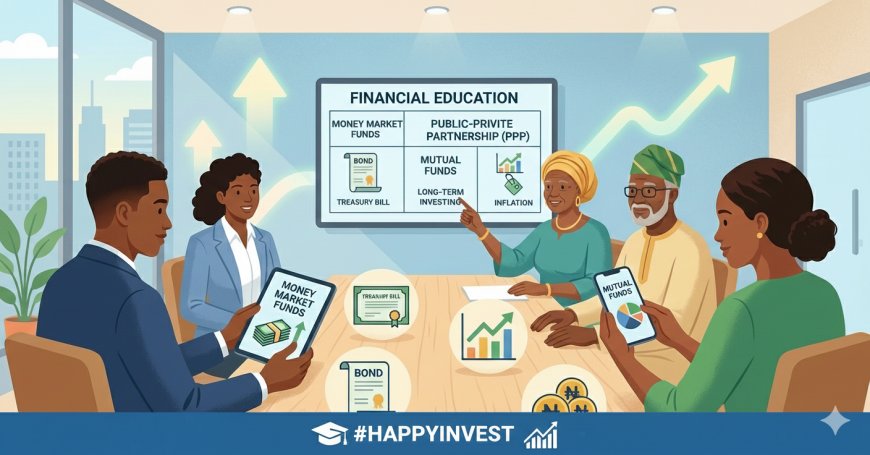

Money Market, Mutual Funds & PPP Explained Simply (A Beginner-Friendly Guide for Nigerians)

Many Nigerians are confused about Money Market Funds, Mutual Funds, and PPP. This simple guide explains how they work, their differences, risks, returns, and how inflation affects them—all in clear language anyone can understand & Learn what Money Market Funds, Mutual Funds, and PPP mean in Nigeria. Discover how money market funds work, the best options, risks, returns, and how inflation affects your investments.

Many Nigerians hear words like Money Market, Mutual Fund, and PPP and immediately feel lost.

Some people even argue:

“Money market is better than mutual fund”

“Mutual fund is risky”

“PPP is only for government people”

But the truth is simple.

Let’s break everything down slowly, clearly, and with real-life examples.

First: All Mutual Funds Are NOT the Same

This is where most people get confused.

A Mutual Fund is like this

Imagine:

-

100 people come together

-

Everyone drops money into one big pot

-

A licensed professional manages that money for them

That big pot is called a Mutual Fund.

So Mutual Fund is the umbrella.

Inside that umbrella, there are different types — just like different kinds of swallow.

👉 Eba, fufu, and amala are all swallow.

👉 Same way, Money Market, Bond Fund, and Equity Fund are all Mutual Funds.

Types of Mutual Funds

-

Money Market Fund (lowest risk)

-

Bond Fund

-

Equity Fund (highest risk)

-

Balanced Fund (mix of everything)

So please remember this:

Money Market is NOT opposite of Mutual Fund.

Money Market is a TYPE of Mutual Fund.

What Is a Money Market Fund? (Simple Example)

Let’s use a common-sense example 😄

A student by the name Jan-Mary has ₦200,000.

She says:

-

“I don’t want stress.”

-

“I don’t want my money to disappear.”

-

“I just want small, steady interest.”

So instead of keeping the money idle, her money is used to lend to:

-

Treasury Bills

-

Commercial Papers

-

Bank placements

These are short-term, low-risk borrowings.

That is exactly what a Money Market Mutual Fund (MMF) does.

Why People Like Money Market Funds

-

Low risk

-

Steady returns

-

You can withdraw almost anytime

-

Good for emergency funds

That’s why people say “money market is sweet,” it’s flexible.

How Does a Money Market Fund Work in Nigeria?

Very simple:

-

You invest money into a Money Market Fund

-

Fund managers invest it in safe short-term instruments

-

Interest is earned daily

-

Returns are added gradually

-

You can withdraw when needed

No trading stress.

No monitoring charts.

Which Banks Operate Money Market Funds in Nigeria?

Many Nigerian banks and investment firms run Money Market Funds.

Popular ones include:

-

Zenith Money Market Fund

-

Coronation Money Market Fund

-

Stanbic IBTC Money Market Fund

-

ARM Money Market Fund

-

Meristem Money Market Fund

So to answer clearly

Which bank in Nigeria runs Money Market Funds?

==> Zenith Bank, Stanbic IBTC, Coronation, ARM, and others (through their asset management arms).

What Is the Best Money Market Fund in Nigeria?

There is no single “best” for everyone.

The best depends on:

-

Your goal

-

Your withdrawal needs

-

Fund consistency

-

Trust in the manager

Many Nigerians trust:

-

Zenith Money Market Fund

-

Stanbic IBTC Money Market Fund

-

Coronation Money Market Fund

But remember:

Money market returns can change anytime.

Why Money Market Returns Go Up and Down

Money Market Funds depend on:

-

Inflation

-

Treasury bill rates

-

Interest rates

Example from recent times:

-

Paid around 22% early 2025

-

Dropped to 20%

-

Dropped again to 18%

-

Now many are paying 15–16%

Why?

Because inflation dropped:

-

22% -> 20% -> 18% -> 16.05%

When inflation drops:

-

Treasury bill rate drops

-

Money market returns drop

What About Bonds and Other Mutual Funds?

Now let’s talk about Mutual Funds beyond Money Market.

Bond Fund

-

Invests in government & corporate bonds

-

More stable long-term

-

If you buy a bond at 15%, it stays 15% till maturity

Equity Fund

-

Invests in shares (stocks)

-

Higher risk

-

Higher potential returns

Balanced Fund

-

Mix of bonds + shares

-

Medium risk

That’s why professionals prefer bonds for long-term stability.

Dollar Mutual Funds in Nigeria

Some mutual funds invest in US dollar assets.

They help:

-

Protect against naira depreciation

-

Earn dollar-based returns

They are useful for people planning:

-

International education

-

Travel

-

Dollar savings

What Is PPP? (Public-Private Partnership)

PPP simply means:

Government + Private Investors working together

They join hands to build big things like:

-

Roads

-

Bridges

-

Railways

-

Markets

-

Hospitals

-

Housing estates

The government provides support.

Private investors bring money and management.

PPP is how big national projects get funded without the Government carrying all the burden.

example of PPL: NIDF, CIDF

My Personal View as an Investor

Here’s the truth

-

If you want flexibility & low risk: Money Market Fund

-

If you want stable long-term returns: Bond Fund or FGN Bonds

-

If you can handle ups and downs: Equity Fund

But always remember:

Your age, goal, and risk tolerance determine the best investment — not hype.

Final Truth

If you understand:

-

Money Market

-

Mutual Funds

-

PPP

-

Bonds

-

Inflation impact

-

Interest rate strategy

You already know more than 85% of Nigerians about investing.

Knowledge is wealth.

And at HappyInvest, our goal is simple:

Make money education simple for everyone — even a teenager.