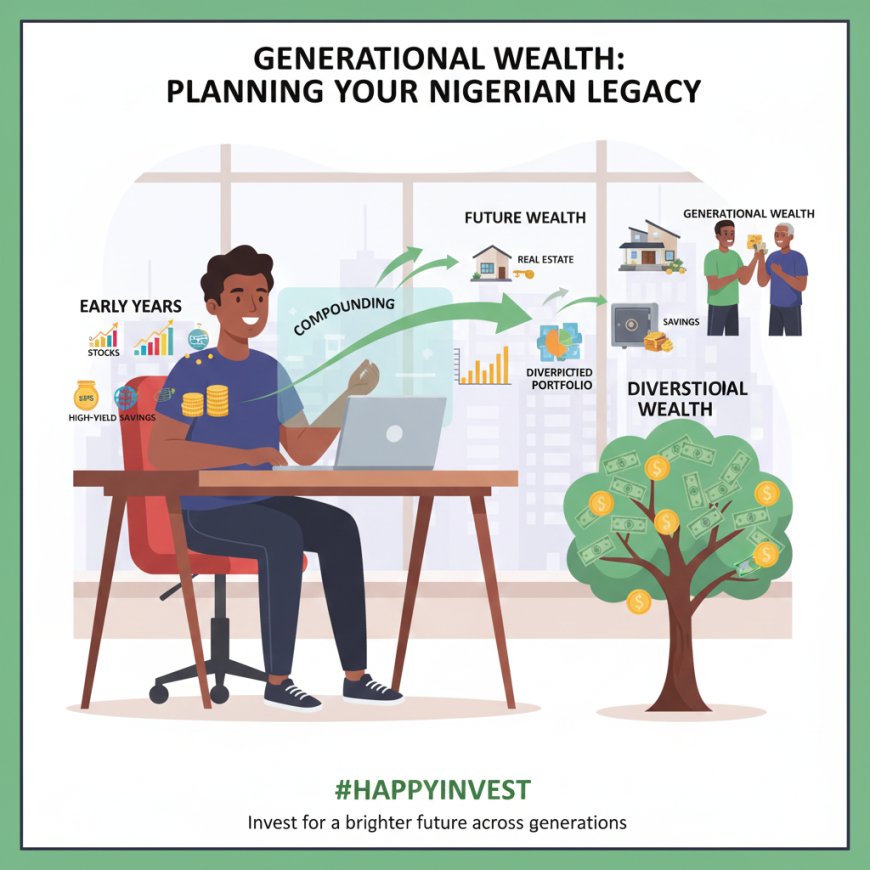

How a Young Nigerian Man Can Build Wealth That Lasts

Generational wealth is not built overnight. This guide explains how young Nigerian men can start building lasting wealth through smart investing, long-term thinking, income discipline, and asset ownership—so their children won’t have to start from zero.

Generational Wealth Planning

Most people work hard all their lives…

Yet their children start from zero again.

That’s not generational wealth.

Generational wealth means:

What you build today continues working for your children, even when you are no longer around.

You don’t need to be a politician, oil tycoon, or lottery winner.

You just need time, discipline, and the right strategy.

Let’s break it down simply.

1. Understand This First: Generational Wealth Is a Process, Not a Jackpot

Many young Nigerian men think:

-

“If I make one big money, I’m set.”

-

“If I hammer once, my children are secure.e”

That mindset is dangerous.

Generational wealth is built through:

-

Assets

-

Systems

-

Long-term thinking

Not sudden spending.

2. Start Early: Time Is Your Greatest Advantage

As a young man, your biggest asset is time, not money.

If you start investing at:

-

20 years old

-

25 years old

You have 30–40 years for compounding to work.

Nigerian Reality Example

A man who starts investing ₦10,000 monthly at 22

vs

Another who starts ₦100,000 monthly at 40

The first person can still end up richer.

Why?

👉 Time beats amount.

3. Build Income First, Then Assets

Before thinking of “generational wealth,” ask:

“How am I earning money consistently?”

As a Young Nigerian Man:

Focus on:

-

A skill (tech, design, sales, writing, engineering, business)

-

A job or business

-

Side income

Income is the fuel.

Assets are the engine.

You can’t invest what you don’t earn.

4. Convert Income into Assets (This Is the Real Game)

Most Nigerians earn money…

Then spend everything.

Wealthy people earn money…

Then convert it into assets.

Assets You Can Build in Nigeria:

-

Stocks (NGX & foreign)

-

ETFs

-

Bonds

-

Real estate (later)

-

Businesses

-

Intellectual property

📌 Rule:

Don’t just earn money.

Turn money into things that produce more money.

5. Invest Consistently in Stocks & ETFs

Stocks and ETFs are powerful tools for generational wealth because:

-

They compound

-

They can be passed down

-

They grow with the economy

Nigerian Strategy:

-

Invest monthly (₦5k, ₦10k, ₦50k — any amount)

-

Focus on strong companies and ETFs

-

Reinvest dividends

Examples:

-

NGX blue-chip stocks

-

NGX ETFs

-

Global ETFs (when possible)

This is how wealth quietly grows.

6. Think in Decades, Not Months

Poor mindset asks:

-

“How much did I make this week?”

Wealth mindset asks:

-

“Where will this be in 20 years?”

Generational Thinking

When you invest, ask:

-

Will this still exist in 20–30 years?

-

Can this grow without my daily effort?

That’s how rich families think.

7. Control Lifestyle Inflation (This Destroys Generational Wealth)

As income increases, expenses increase too.

New phone

Bigger apartment

More outings

More pressure

Generational wealth builders do this instead:

-

Increase investments faster than lifestyle

-

Delay unnecessary enjoyment

-

Live below their means

📌 Wealth is not what you show.

Wealth is what you keep and grow.

8. Protect Your Wealth (Very Important)

Many Nigerians build wealth…

Then lose it through:

-

No planning

-

No documentation

-

No structure

Simple Protection Steps:

-

Keep records of investments

-

Separate personal spending from investments

-

Learn basic estate planning

-

Avoid emotional investing

Wealth without protection does not last generations.

9. Teach the Next Generation Early

Generational wealth is useless if children don’t understand it.

Teach them:

-

How money works

-

Why investing matters

-

Discipline

-

Responsibility

Wealth is not just money.

It’s knowledge + values.

10. Be Patient: This Is a Long Game

Generational wealth is slow.

Quiet.

Boring.

But powerful.

Most people chase fast money.

Few build lasting systems.

📌 You don’t need to be rich today.

📌 You need to be consistent.

Final Message to Young Nigerian Men

You don’t build generational wealth by:

-

Waiting

-

Complaining

-

Hoping for luck

You build it by:

-

Starting early

-

Investing consistently

-

Thinking long-term

-

Controlling lifestyle

-

Protecting what you build

If your parents couldn’t leave you wealth,

You can be the one who changes the story.

Start now.

Your children may never know the sacrifices.

But they will enjoy the results.