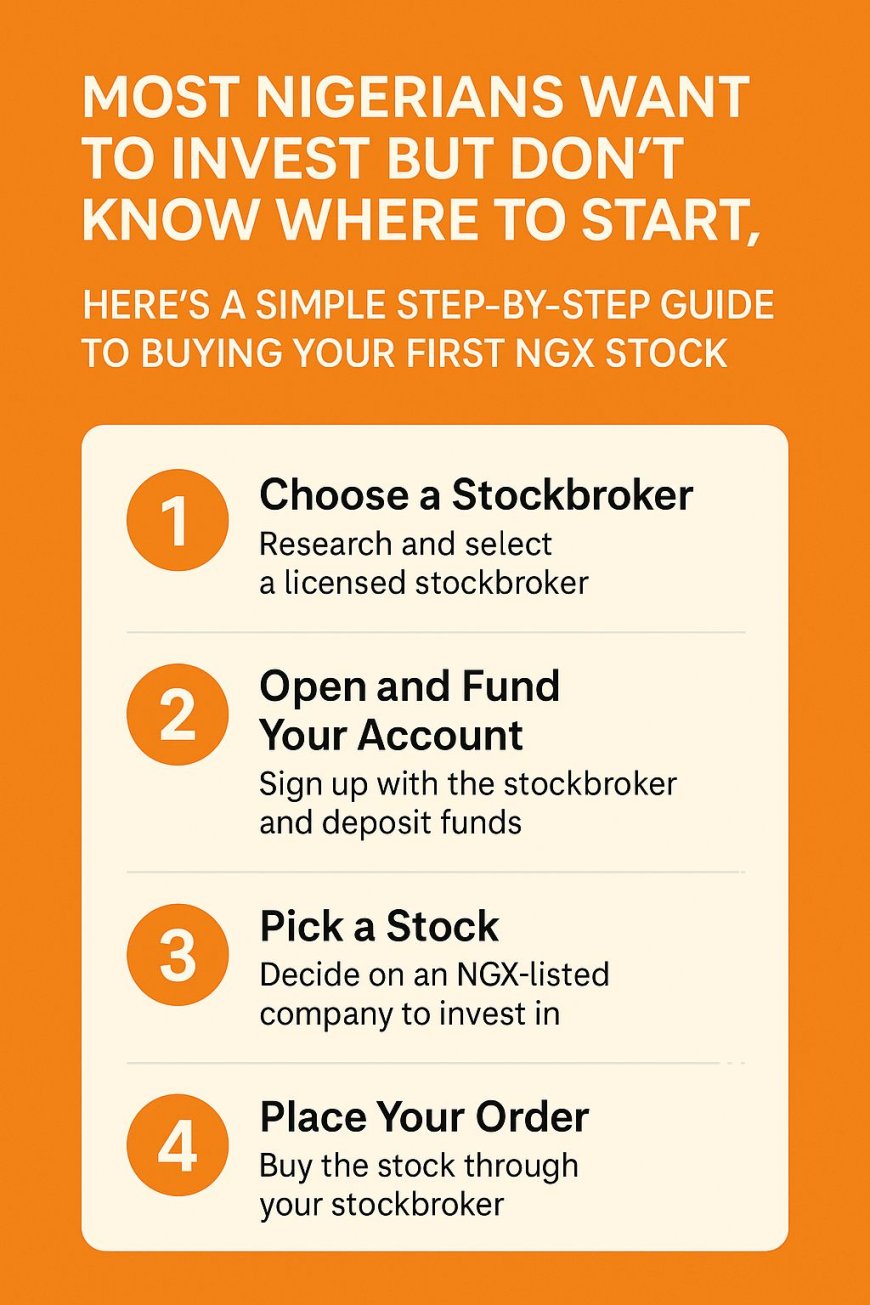

Most Nigerians Want to Invest but Don’t Know Where To Start, Here’s a Simple Step-by-Step Guide to Buying Your First NGX Stock

Most Nigerians want to invest but don’t know where to start. This article gives a beginner-friendly, step-by-step guide to buying your first NGX stock, from choosing a broker to owning your first shares. Learn how to buy your first NGX stock in Nigeria with this simple, beginner-friendly guide. Discover how to choose a broker, open an account, fund it, and confidently buy your first shares.

Most Nigerians today want to invest.

They want to grow their money.

They want to escape inflation.

They want something better than just “saving” in a bank account that doesn’t grow.

But the reality?

Many people are unsure of how to begin.

They don’t know who to trust.

They don’t know the first step to take.

If this sounds like you, you’re not alone.

Let me tell you a short story.

A Story Every First-Time Investor Will Relate To

Chinwe, a young professional in Lagos, had been hearing everyone talk about “buy stocks,” “invest in NGX,” and “build wealth.”

So she told herself:

“I want to invest too.”

But when she finally sat down to start, she froze.

Which stock should I buy?

Which broker is safe?

How much money do I need?

What if I lose everything?

The fear, confusion, and information overload pushed her away.

So she postponed it.

Then postponed again.

And months passed with zero investment.

This is the exact experience of millions of Nigerians who want to grow wealth but feel stuck at the starting line.

The good news?

Investing in Nigerian stocks is way easier than you think once someone explains it in plain English.

So let’s do that.

A Simple Step-by-Step Guide to Buying Your First NGX

Stock

This guide is designed for absolute beginners.

No jargon. No confusion. No pressure.

Let’s start.

Step 1: Understand What NGX Really Is

NGX = Nigerian Exchange Group.

It’s simply the marketplace where Nigerian companies list their shares.

When you buy a stock, you’re buying a small piece of that company.

Examples of companies on NGX:

-

GTCO

-

Zenith Bank

-

MTN Nigeria

-

BUA Foods

-

Airtel Africa

You don’t need to be rich to invest.

You don’t need millions.

You can start small.

Step 2: Choose a Trusted Stockbroker

To buy any stock, you must use a registered broker.

Here are popular and reputable options:

-

Chapel Hill Denham (Invest Naija)

-

ARM Securities

-

MeriTrade (Meristem Securities)

-

Stanbic IBTC Stockbrokers

-

CardinalStone

- Afrinvest 2.0

- Bamboo

- Chaka

What you should look for:

-

Easy account opening

-

Low fees

-

A simple app/dashboard

-

Good customer support

-

Regulated by the SEC

A good broker makes the entire investing process stress-free.

Step 3: Open a Stockbroking Account

This usually takes 5–15 minutes online.

You’ll need:

-

BVN

-

Valid ID

-

Passport photo

-

Email & phone number

After registration, your broker creates your CSCS account, which is akin to a “bank account for stocks,” where your shares will be stored securely.

Step 4: Fund Your Account

You can transfer any amount to your brokerage account.

Starting with ₦5,000 – ₦20,000 is perfectly fine.

The important thing is starting, not the amount.

Step 5: Choose Your First Stock

This is where most beginners panic — but keep it simple.

Ask yourself:

Does this company make money?

Do I understand what they do?

Have they been stable for years?

Beginner-friendly NGX sectors:

-

Banking (Zenith, GTCO, Fidelity)

-

Telecoms (MTN, Airtel)

-

Consumer Goods (Nestlé, BUA Foods, Nigerian Breweries)

Avoid chasing hype.

Pick strong, stable companies with a solid track record.

Step 6: Place Your Buy Order

On your broker app:

-

Search for the stock name

-

Enter the amount or number of shares

-

Submit your “buy” order

Once approved, congratulations — you officially own your first stock!

Your shares appear in your CSCS account, safe and secure.

Step 7: Hold, Learn, and Grow

The biggest mistake new investors make is expecting quick returns.

Real investing takes:

-

Time

-

Patience

-

Consistency

Check your portfolio occasionally, not every minute.

Add more money monthly if you can.

Learn little by little.

Your future self will thank you.

The Truth Most Nigerians Don’t Know

Investing is not only for rich people or finance experts.

It’s for anyone who wants to grow financially and protect their future.

Millions WANT to invest…

Millions THINK investing is hard…

But the truth is:

Investing is simply a journey and the first step is easier than you imagine.

The Solution (Your Next Step)

If you’re ready to finally start your investment journey:

-

Pick a broker

-

Open your account

-

Fund it

-

Buy your first stock

-

Keep learning and stay consistent

And if you want simple, beginner-friendly investing education made for Nigerians, HappyInvest will guide you at every step.

Your financial future starts with one decision. Take that step today